Meme coin Shiba Inu sees over 50% weekly price increase fueled by a growing number of token holders and an upward rally in the crypto market.

Shiba Inu, a dog-themed meme coin, saw an upward surge in its price this week. The digital currency recorded a daily spike of over 17%, bringing its weekly gain to over 50%. The move coincided with a broader recovery in the crypto market, with Bitcoin and Ether regaining the $42,000 and $3,000 price levels, respectively.

However, a closer look at on-chain data shows that Shiba’s price is also backed by a growing number of holders and positive social sentiments.

Shiba’s Growing Token Holders

The on-chain data provided by IntoTheBlock reveals that SHIB holders have demonstrated significant confidence in the meme coin. Since November 1, holders between 1-12 months have increased from 533,180 addresses to 1.05 million. This is a 94% increase in just three months, with 6% of addresses holding for less than a month.

Source: IntoTheBlock

Furthermore, the on-chain data shows that at the current price of $0.000033, 52% of SHIB token holders are in profit. Those who FOMOed in and brought at the top and are now in loss account for 30%, while 18% are neither profiting nor losing.

Despite the growing number of holders, the concentration of SHIB’s circulating by whales stands at 79%, a possible cause of concern. However, the value of transactions over $100,000 has reached $623.37 million over the past week.

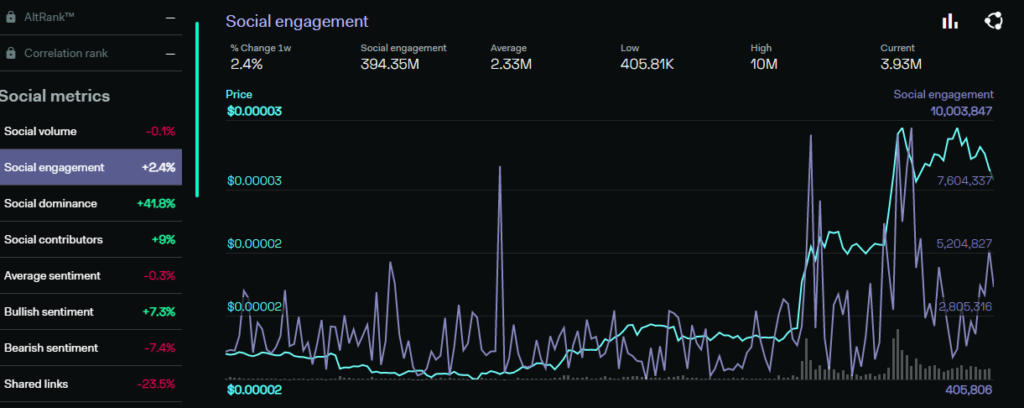

A look at social metrics provided by LunarCrush shows that Shiba’s social Volume, average sentiment and bearish sentiments are all negative. However, other metrics like social dominance, bullish sentiments, and social media volume are positive.

Shiba’s social engagement chart.

Source: LunarCrush

Shiba’s social engagement has increased by 2.4% in the last week, totalling 394,35 million interactions. From the chart, social engagement does not always correlate with meme coin price. There seems to be an inverse relationship between both metrics, with social engagements spiking at lower costs and falling as the price rises.

Other Factors Causing A Price Spike

Several other factors may also be responsible for the increase seen in Shiba Inu’s price. Despite having no change to its fundamentals, the announcement of a valentines day token burn may have created bullish sentiments.

On Sunday, Bigger Entertainment’s CEO, Steven Cooper, announced that his company’s valentines day event will see the biggest burn party yet. The crypto entertainment firms business is largely based on burning SHIB tokens equivalent to the value of tickets sold for its events. The current plan sees the company plan to burn 162 million SHIB on valentines day.

Aside from the impending token burn, several new projects within the coin’s community have been pointed as reasons for the upward momentum. Unification, a Singapore-based blockchain solutions provider, announced it was building Shibarium, a layer 2 blockchain built on Ethereum but exclusive to the Shiba Inu’s ecosystem. Shibarium is expected to enable rapid, low-cost transactions for optimized gaming on Shiba Inu.

Also, Shytoshi Kusama, the coin’s top influencer on Twitter, announced a partnership between Shiba Inu and Welly’s, a burger restaurant in Italy. SHIB will manage Welly’s payments as part of the deal, integrate NFTs and Shiba Inu’s blockchain into Welly’s business, and lead the outlet’s business strategy.

Finally, Elon Musk’s approval over time has also helped boost the positive sentiments about the token for its holders. The current world’s richest man tweeted about getting a Shiba Inu dog, and this saw the coins price surge up by over 300%

However, sceptics believe Shiba Inu’s popularity will fade and that the meme-coin will remain a risky venture with little underlying value.

Do you think Shiba Inu can develop more utility and become more than just a meme coin? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.