Nigeria’s adoption of Bitcoin continues apace despite the CBN’s ban on cryptocurrency, with P2P trading volume increasing by 15% year over year.

Data from LocalBitcoins and Paxful reveal that peer-to-peer(P2P) trading has continued to grow in Nigeria. The West African country recorded a 15% year over year increase in P2P trade volume despite the ban on crypto by the country’s apex bank.

Nigerians, who recently had a spat with Binance, for which the exchange’s CEO issued an apology, had a crypto ban enforced in February 2021. However, trading activities among market participants from the region has continued unabated.

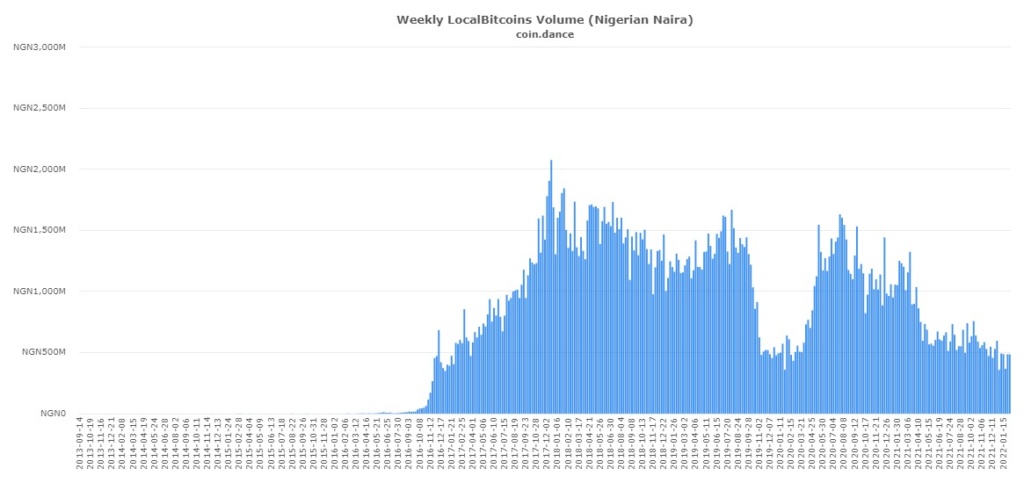

Weekly LocalBitcoins Volume.

Source: Coin Dance

Trade Volume Grows Amidst Pressure On the Naira

With the Nigerian Naira performing weakly against the US dollar, crypto adoption has continued to rise. According to a Finders survey, the country now has the highest crypto adoption rate ahead of Malaysia and Australia. The adoption rates hit 24% with over the equivalent of over $400 million traded on P2P platforms.

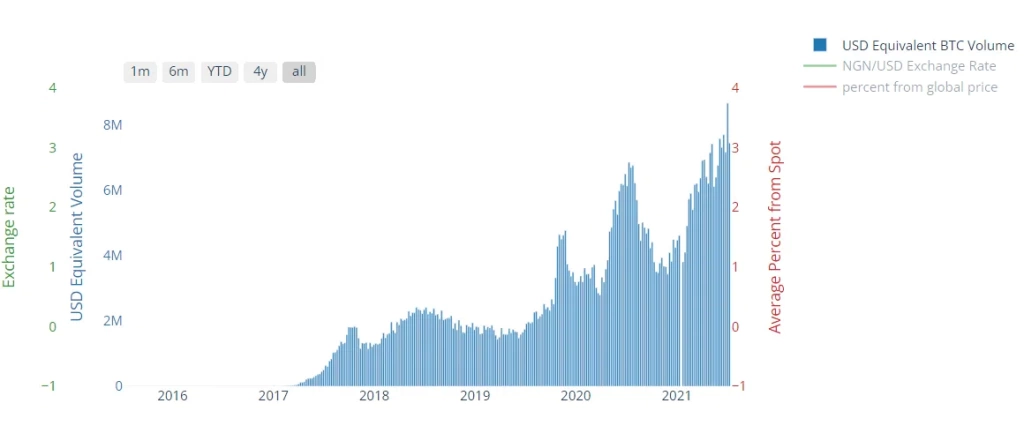

Trading volume in NGN. Source: UsefulTulips

Report emerging from Nigeria shows that the Naira fell significantly against the dollar for the first time this month. The currency exchanged at ₦570 per dollar since January 20 2021, but a market survey this week revealed it was trading at ₦571 per $1. These numbers represent the value on the parallel market popularly referred to as the black market.

However, the CBN has said it does not recognise the parallel market and has urged citizens who need forex to approach their local banks. It further insisted that the Investors & Exporter (I&E) window is the only exchange it recognises.

Despite the naira losing ground at the black market, it showed strength at the official market, gaining more than ₦1 naira. However, the FMDQ Security Exchange data of officially traded forex showed a 0.06% drop in value. The naira opened at ₦415.51 per dollar and closed at ₦416.33 per $1.

The I&E exchange window also corroborates the tightening pressure on the Naira. Data released revealed that the downward slide in the strength of the naira against the dollar coincided with an 84.4% increase in FX turnover. The effect of this has been a marginal reduction by 0.006% in the country’s foreign reserve. The reserve holdings lost $2.2 million on February 4 2021, closing at $39.98 billion.

Possible Ray Of Hope For Crypto

It is not all doom and gloom for the crypto lovers in Nigeria. The country’s vice president has called on the CBN to regulate crypto instead of banning it. It is yet to be seen if the apex bank will heed his call. Meanwhile, the CBN continues to push for widescale adoption of its E-Naira, Nigeria’s own central bank digital currency (CBDC). A wallet and a website have now been launched with the CBN focusing on this development much like other countries.

Governments worldwide are eager to take advantage of blockchain technology while limiting its effects on their economies. Several countries have announced CBDC tests, with India being the most recent. China has already completed many large-scale tests, while others are still in the proof-of-concept stage.

However, Nigeria is well-positioned to continue its dominance in crypto adoption if the CBN removes the current restrictions. Many investors in the country would be hopeful for a change of stance to enable them to invest freely without any fear of frozen accounts or breaking the laws.

Do you think more Nigerians will turn to crypto in the face of continued pressure on the Naira? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.