The number of addresses holding between 0.1- 1 ETH grew dramatically last year, proving that retail investors are getting skin in the game.

An IntoTheBlock analysis shows that the number of addresses holding between 0.1 and 1 ETH is now at an all-time high. The on-chain data revealed that retail holders grew by 98% over the past year. Consequently, these investors now collectively hold 1.78 million ETH, a 4.54% increase on last months holdings.

Retailers Getting Skin In The Game

The on-chain metric has substantiated the notion that Ethereum’s adoption is not exclusively for the big player and whales. Instead, smaller investors are getting skin in the game, slicing off a decent share of ETH for themselves along the way.

Source: IntoTheBlock

The total number of retail addresses holding between 0.1 to 1 ETH stood at just over 2.4 million in the chart above. Over the year, the number grew by 98% to 5.4 million recorded on January 31 2022.

This influx of retailers has coincided with the noticeable spike in the price of Ether. The value of the top altcoin went from about $1000 to record an all-time high price just shy of $5000. The May-June 2021 market capitulation and current price slump have not deterred these investors. Instead, they have continued accumulating the digital asset as confined by the number of retail addresses hitting a new ATH.

A further breakdown of the data shows that whale addresses having over a million ETH declined by 14.29% in the last month. The fall coincided with a generally good performance from other wallet holder categories. Addresses in the 0.1-1 ETH range performed better with a 4.37% increase. The 1-10ETH holders were the next best performers with a 3.38% rise, followed by the 0.01-0.1 addresses recording a 3.22% growth.

An underlying reason for this reduction may be the general FUD that has plagued the market and precipitated the current slump. Most of these whales may be selling a portion of their holdings to book some profits. However, lower gas fees on the Ethereum network has given more retail holders the needed boost to accumulate the digital asset.

Falling Gas Prices Encouging Retail Activities

Over the past year, improvements to the Ethereum network have dramatically reduced average gas prices. The London hard fork— Ethereum Improvement Protocol(EIP) 1559— combined with the introduction of Layer Two solutions like Arbituim, Optimism, and Polygon have positively affected gas prices.

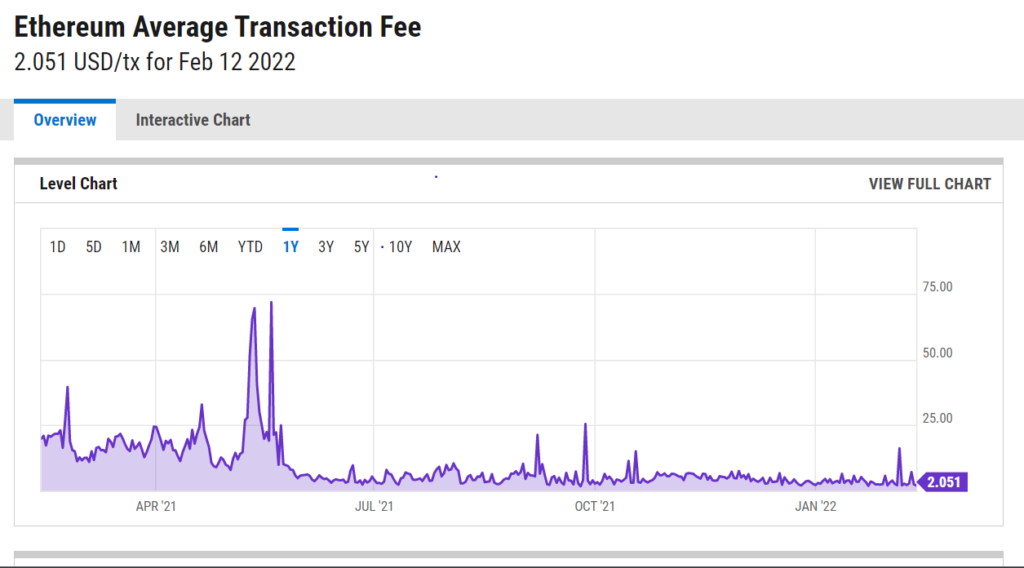

Source: Ycharts

The vast reduction in gas fees in the past year is noticeable in the chart above. Currently, Ethereum’s Average Transaction Fee is 2.051, down 89.64% from 19.81 a year ago. Over the period, frequent congestions caused spikes on the network; however, these surges have been relatively muted since the upgrades.

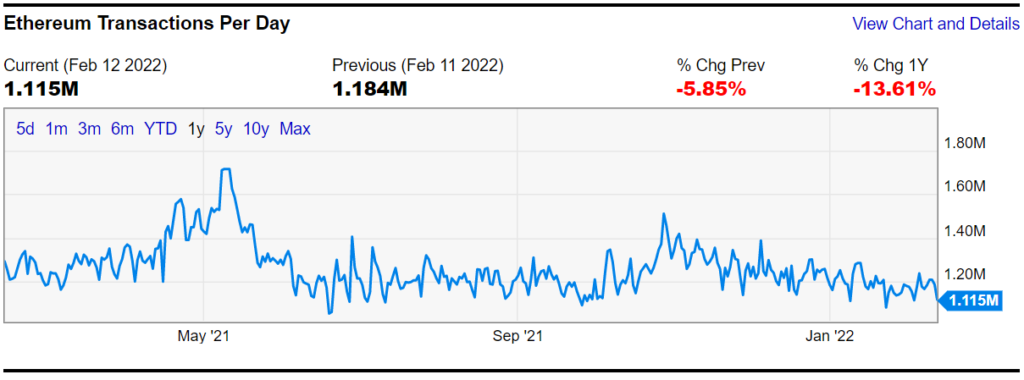

This drop might be the reason for the influx of retail investors who are easily discouraged by the high gas fees. The prior situation allowed whales to enjoy a large chunk of the spoils during the bull season. Likewise, the volume of daily transactions has also settled to a low of $1.206 million. This indicates that large players might be giving smaller investors more room to participate in the market.

Source: Ycharts

Overall, the improvements in the Ethereum network has seen a positive price correlation for the asset. With lower gas fees and fewer congestions, more developers and investors have continued using the smart contract platform with lower gas fees and fewer congestions. Despite recording a slump in the number of developers on it, its first-mover status still makes it an obvious and secure choice.

Currently, the value of one ETH is $2889, down nearly 40% from its ATH price of $4878 recorded 3 months ago. Retail investors would be chomping at the opportunity to buy the dip and hodl to take profit when the market swings to the upside.

Do you think retail investors will take a greater slice of the ETH’s circulating supply while the market is still in a slump? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.