DeFi continues to grow, with the total value locked in these protocols continuing to hit new highs outperforming traditional finance platforms.

Decentralised Finance or DeFi, which has fueled the crypto boom since 2020, has continued to see growing sums poured into it. The crypto trend offering blockchain-based services like borrowing, investing, and trading, much like traditional banks, has continued to pique investor interest.

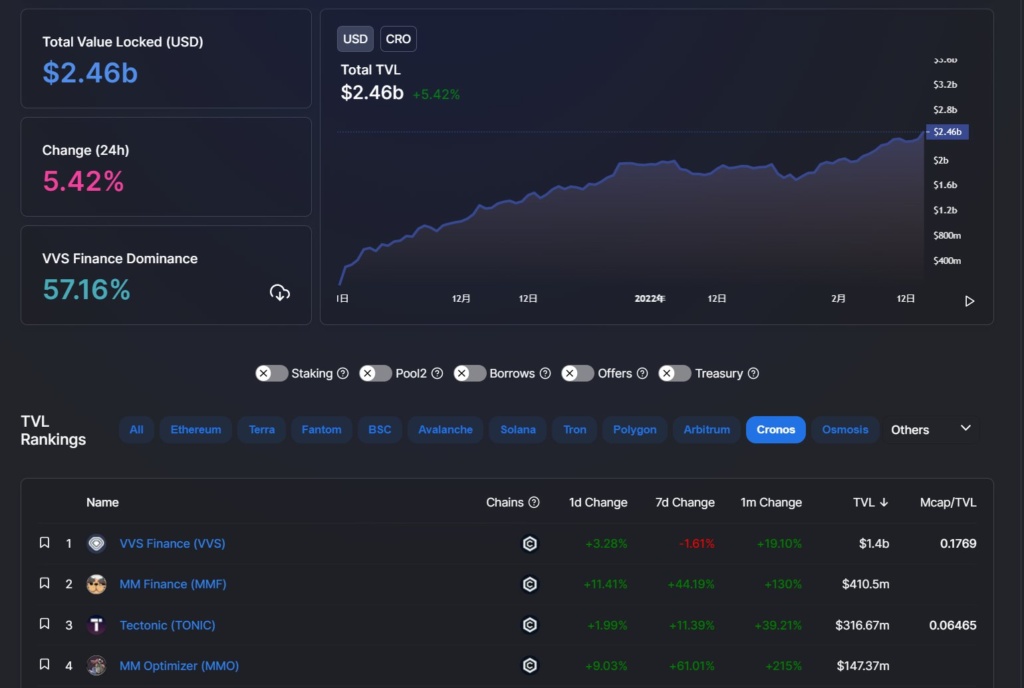

According to DeFillama, Crypto.com’s Cronos chain saw more inflow which has caused its TVL (total value locked) to hit new a high. With a TVL just shy of $2.5 billion, the ecosystem has entered the top 10 chains with the highest value locked. Native protocols like MM Finance and MM Optimizer have recently seen significant spikes in their TVLs.

Total Value Locked on the Cronos ecosystem. Source: DeFillama

The DeFi Boom Continues

Few trends or topics are talked about within the crypto industry as much as DeFi. It is regarded as not only the future of blockchain technology but finance as we know it. This attention sees new protocols leveraging on its capabilities spring up daily.

DeFi is attractive to investors because of the absence of intermediaries when transactions happen. This ensures users carry out their business at more incredible speed, privacy, and reduced cost. DeFi burst onto the scene in 2020, with several protocols offering a wide range of services. The dominant categories included borrowing and lending, decentralised exchanges, Asset Management Protocols, Decentralized Prediction Markets, Options and Insurance, and Synthetic Asset Bridges.

According to DeFipulse, the TVL locked in DeFi smart contract in august 2020 stood at $8 billion. Since then, the evolution and adoption of the crypto industry have seen new ecosystems and protocols emerge, leading to growth.

According to Statistica, the market size of DeFi grew to a staggering $274 billion as of November 2021. This growth is even more impressive considering the March market crash and the emergence of non-fungible tokens (NFT) and Web 3. However, the price slump in the industry has seen the TVL drop to around $198.57 billion.

TVL in DeFi. Source: DeFillama

More Options Causes Growth

Arguably, the most significant cause of growth for DeFi has been its expansion across multiple chains. This has seen users move from one protocol to the other to take advantage of speed, low transaction fees and higher returns on their investments in these ecosystems.

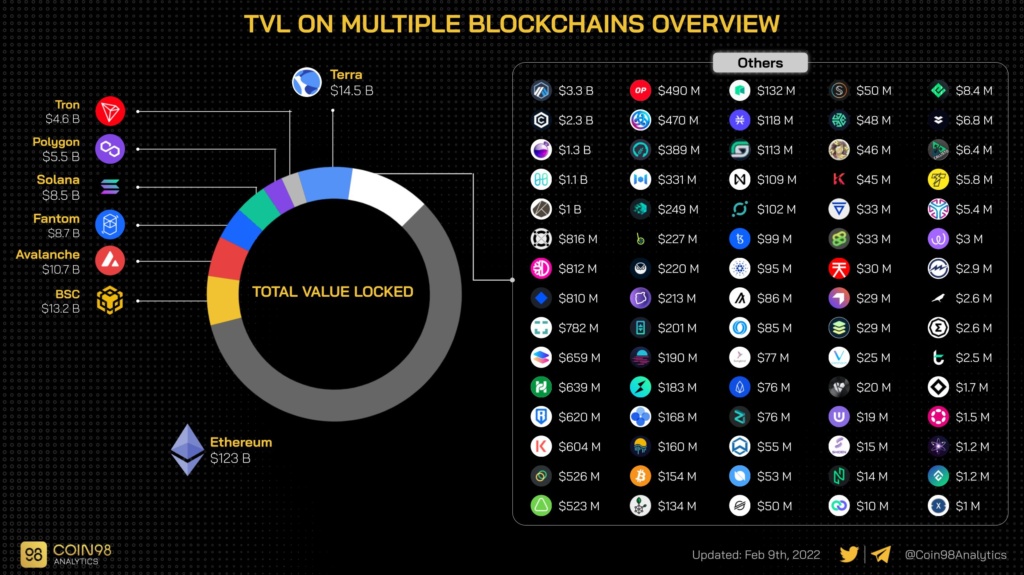

According to Defillama, a total of over 80 chains with more than 1500 decentralised applications (DApps) offer DeFi services. Ethereum, whose token Ether recently recorded high volume, leads the way in terms of TVL and the number of protocols.

The Smart contract king has almost 59% of DeFi TVL with over $116 billion locked across 537 protocols. It is followed closely by Terra with $15.36 billion across 18 Dapps. The Binance Smart Chain(BSC) wraps up the top three with a TVL of $12.57 billion and 313 protocols. The list sees Avalanche, Fantom, Solana, Tron, Polygon, Chronos, and Osmosis in the top ten, respectively.

Source: Coin98Analytics.

The strong performance of DeFi shows that more people are attracted to decentralised platforms, including Exchanges, as opposed to Centralized platforms.

Do you think DeFi will be the future of finance and the blockchain? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.