Russian and Ukrainian crypto markets have reacted positively to the escalating geopolitical tension between both countries.

Russia’s ongoing invasion of Ukraine has turned a spotlight on cryptocurrency as both countries utilise the advantages of the technology. Now called the first crypto war, the conflict has elicited a spike in transactions across centralised exchanges for the Ruble and the hryvnia.

The decentralised nature of crypto has proved helpful to Russia in the face of growing sanctions from the US and other Western countries. Meanwhile, Ukraine has turned fully to the digital asset to receive donations to aid its defence effort. The current situation has put the crypto industry in an unusual and risky position. It will need to find the balance between sanctions enforcement and its incapacity to prevent transactions on decentralised networks.

Invasion Triggers Volatility Causes Spike In Demand And Transaction Volumes

The immediate aftermath of the invasion saw the global financial market sell-off. The crypto market plummeted while the S&P 500 entered a technical correction. However, the commodities market saw prices soar, induced by fear of supply disruptions. The markets rebounded on Friday, with Bitcoin showing remarkable resilience.

Source: Kaiko

The resilient nature of the crypto market is seen in the chart above. Bitcoin and Ethereum were trading around the $39000 and $2700 price range, respectively, before the invasion. BTC fell by almost 7%, breaking below the $36000 support before reversing and even surpassing its initial price before the crash in two days. A similar occurrence happened with Ether, with its native blockchain losing ground to other ecosystems due to scalability issues.

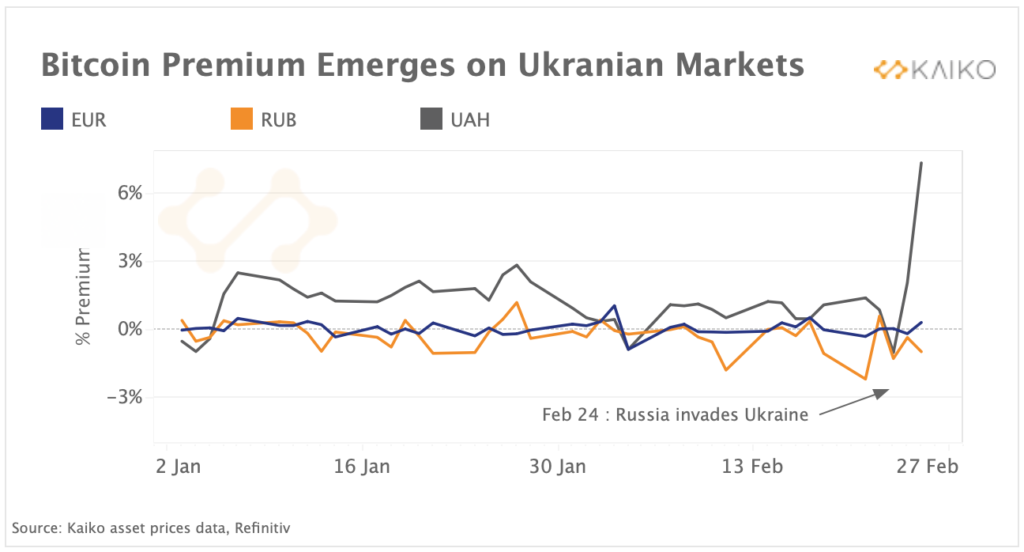

Consequently, the quick rebound in the price of digital assets can be attributed to the increasing demand for them following the invasion. This demand caused Bitcoin to trade at a 6% premium to the Ukrainian hryvnia (UAH) on Binance. The crypto exchange saw a boost in demand following disruption of the local currency market as the hryvnia fell to new lows against the dollar. In response, the Central bank of Ukraine suspended foreign currency withdrawals and inadvertently caused the spike in demand.

Source: Kaiko

The premium compares the price of Bitcoin in a local currency against its price in dollars. As seen above, the BTC- Rub (Rouble) and BTC-Eur(Euros) premium remained relatively stable. Bitcoin sells at a slight discount in Russia even as its Rouble also fell to new lows against the dollar. This has caused Moscow to hike its interest rate to 20%.

In turn, the increased demand has seen transaction volumes of both the ruble and hryvnia surge to their highest levels in months. The local currency trading pairs surged far faster than the volume of the BTC-USD, implying that the crisis directly influences trading behaviour.

Crypto Proves Useful In the Ongoing Conflict

Digital assets have shown themselves beneficial to both Russia and Ukraine as the ongoing crisis escalate. Moscow’s elite has turned to it in the face of sanctions imposed on the country. Also, fears over reports that the kremlin may nationalise foreign assets make it a viable option for citizens.

Meanwhile, Ukraine garners sympathy from the world with crypto donations exceeding $17 million after crowdfunding efforts. A live dashboard set up to monitor contributions on Ethereum shows that the inflicted country has received over $17 million and counting so far. This does not take into account donations made in Bitcoin and other chains.

The data shows that Ukraine has received approximately $17.02 million from 15097 donors across 27232 transactions today. The donations have originated from various sources, including government bids, DAOs and private donations. Currently, government bids account for almost 50% of funds raised with $8.99 million.

In all, the unfolding events have shown the world the intrinsic value of Bitcoin and how vital it is in the global financial system. When various governments once derided it, it has proved useful, ensuring more attention will be paid to it.

Do you think Cryptocurrencies will play a much more significant role in global finances following their use in the ongoing conflict? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.