Africa catches on with the rest of the world as it finally makes its first foray into the Metaverse.

On Monday, Africa’s largest telecom company MTN announced it has ventured into the Metaverse by purchasing digital land on Africarare. According to the statement, the move makes it the first African country to own digital land in the virtual world.

Africarare Metaverse Ubuntuland is the first African Virtual reality world featuring digital land. It was developed Africarare and Mann Made Media in south Africa and debuted in October 2021. Ubuntuland is expected to showcase the best of African art, fashion, entertainment, sport, technology, and innovation. It will also provide a platform for artists from across the continent to exhibit their work.

Consequently, MTN’s latest acquisition will see it own 144 plots of virtual land with a broad area of 144m2. It also falls in line with its recent rebrand into a technological firm. Bernice Samuels, MTN’s Group Executive for Marketing, expressed the company’s excitement about the opportunities present in the metaverse for customers and the firm.

“This is an exciting moment for us as we lead businesses on the continent to enter the metaverse marketplace. This is exactly what our Ambition 2025 strategy is premised on – leveraging trends that amplify consumer’s digital experiences and engagement. We have always been at the forefront of technological and digital changes, and we remain alive to the exciting opportunities the metaverse presents for us and our customers’’.

Opportunities In The Metaverse

America’s biggest bank, JP Morgan, recently released a report outlining the opportunities in the metaverse after it opened a virtual lounge. It surmised that the virtual world was a potential $1 trillion meta economy with options for the ads industry, service industry and content creators.

Other sectors with potential opportunities include gaming, banking, financial services, and fashion. Jp Morgan urged more companies to venture into it early due to its relatively low risk and potentially high rewards as interest in the space gather steam.

Although a seemingly nascent innovation, the metaverse has been around for some time. It has its origins in the 1992 science fiction novel Snow Crash and has also been referenced in the dystopian fiction series Ready Player one. However, its implementation has seen it evolve from two decades of gaming since the virtual platform second life launched in 2003.

Source: JP Morgan Report

The evolution of the metaverse is somewhat synonymous with the growth and development of popular games, as seen in the timeline above. In the first decade, games drove the adoption of metaverse among individuals. However, 2014 marked the start of institutional adoption. Amazon and Microsoft, within two months in 2014, acquired Twitch and Minecraft, respectively.

The year 2020 saw the release of the blockchain metaverse platform Decentraland, a significant moment in this evolution. However, Facebook’s rebrand to Meta in 2021 marked a watershed moment as it attracted the world’s attention to the virtual space and its possibilities. The social media giant said it is now attempting to create a platform where users can socialise, work, learn, play, shop and create across various apps.

Increased Global Attention Causes Spike In Value For Metaverse Platforms

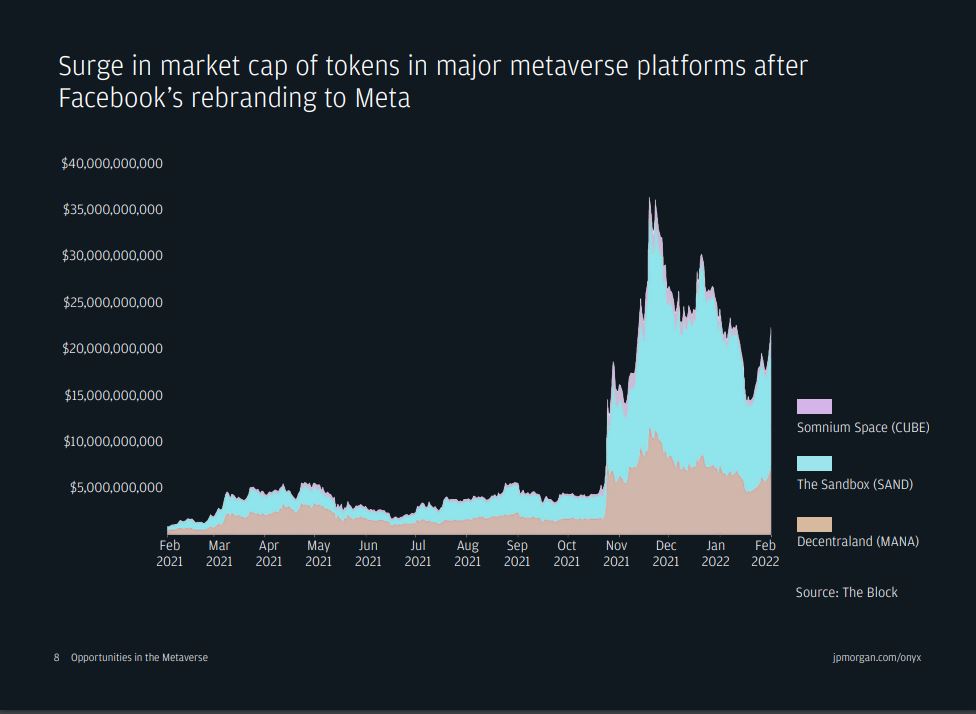

The attention on the metaverse from Meta’s rebrand has had a net positive effect on the entire sector. The immediate aftermath of the announcement saw an upward rally in the market capitalisation of popular metaverse platforms, including Decentraland and Sandbox.

Source: JP Morgan Report

From the chart, the entire market cap of this category shot up almost 700%, from around $5 billion to nearly $35 billion. The surge was fueled by the spike seen in The Sandbox, while the more popular Decentraland also saw a significant rise.

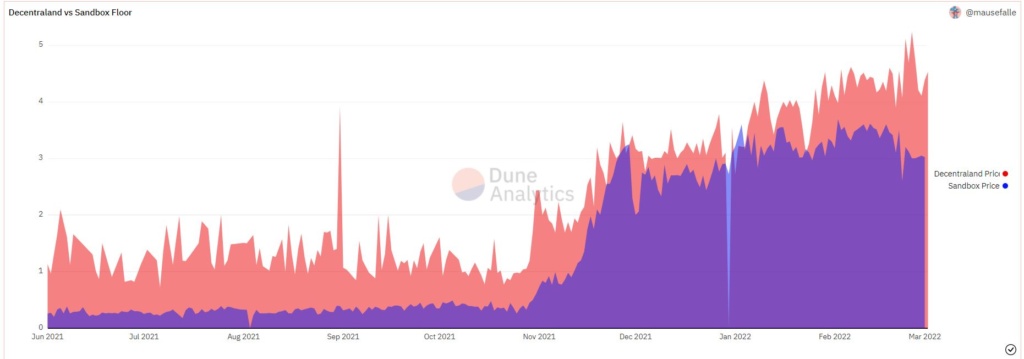

Also, data available on Dune Analytics reveals that the hype of the Meta rebrand also caused an increase in the floor prices of both Sandbox and Decentraland tokens. Mana (Decentraland) saw its price quadruple from around $1 to its current price of $4.3. On the other hand, Sand(Sandbox) surged from around $0.3 to $3, representing a 1000% rise.

Floor Prices of Sandbox And Decentraland.

Source: Dune Analytics

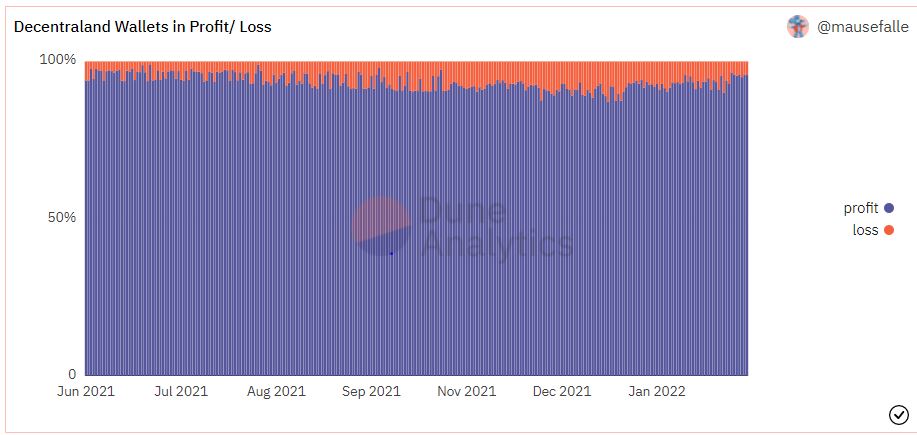

Likewise, the ratio of wallets in profit against those in a loss explains the sustained hype for projects. For Sandbox, the ratio is nearly ¾, as almost 75% of wallets are in profit. Meanwhile, Decentraland has an even high ratio of 9/10, with less than 10% of wallets in a loss.

Source: Dune Analytics

Do you think the Metaverse would be a profitable Venture for African Companies? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.