The bottom of the crypto market may already be in, with on-chain metrics showing whale addresses accumulating stable coins and preparing to take long positions.

The recent sell-off in the crypto market seems to have reached its nadir if on-chain data is anything to be believed. Information provided by Santiment shows that whale addresses have started to accumulate Tether over the last month.

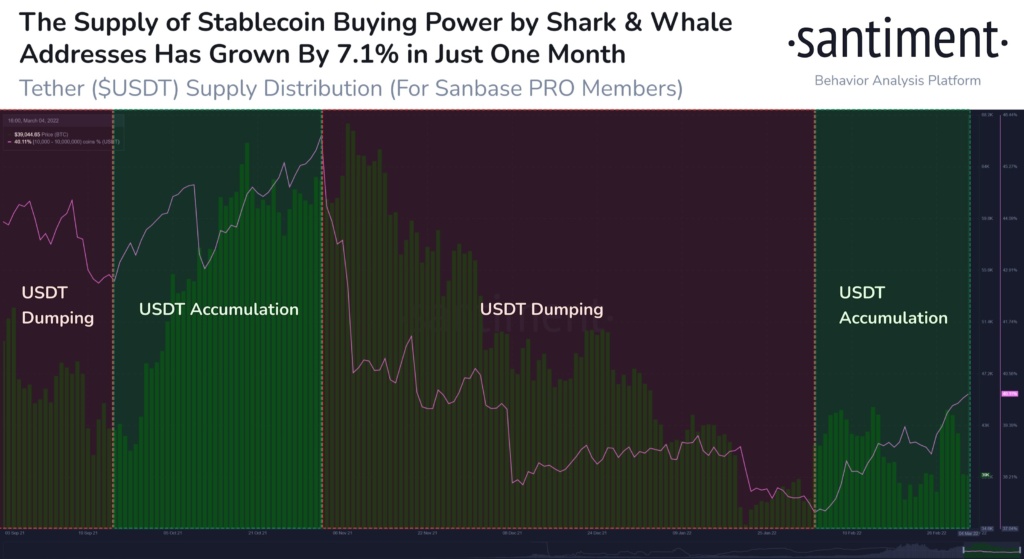

Source: Santiment

The data reveals that whale and shark addresses holding between $10,000 and $10 million added over $1 billion in purchasing power. This represents about 2.7% of the total USDT supply, with the buying ability of this investor class growing by 7.1% in one month.

Whales Sitting On The Sidelines

The action of whale addresses over the last month suggests they may be taking profits after buying the dip. This means they are waiting patiently for the market to get a clear direction before dipping their toes into the pool again. Several crypto proponents substantiate this sentiment on Twitter.

An in-depth look at the data shows that the current percentage of stable coins held by whales and sharks stands at 40%. As seen in the chart above, periods of USDT accumulation usually coincides with a surge in the price of Bitcoin. However, USDT dumping usually sees a fall in crypto asset prices.

Between September and October, the percentage of coins held by whales went from 42.62% to nearly 46%. This coincides with Bitcoin’s surge to a new all-time high price close to $69000. Whales’ subsequent dumping of USDT saw their holding plummet to 37.37%, with Bitcoin also falling.

However, the recent Bitcoin price surge caused by the Russia-Ukraine conflict has also coincided with whales’ percentage increasing. As the war hugged the headlines last month, the crypto market saw a relief bounce as digital assets took centre stage. Ukraine received donations in cryptocurrencies, while Russians converted their wealth to escape sanctions.

Consequently, if the established correlation between Bitcoin and the stablecoins held by whales holds, the crypto market may see an upward price swing.

Retailers Not Left Out

While the Whales and Sharks are accumulating USDT, retailers seem to be doing something similar as their interest returns to the market. Statistics released by data aggregator, IntoTheBlock shows that the number of retail addresses holding Bitcoin for more than 30 days has grown. These retail traders have increased their balance by 4.2%.

Further data shows that investors holding between 0.1-1 BTC now have a record 780,000 BTC. The performance of this retail group saw them outperform other investor classes last month. The group saw a 1.72% increase in their holdings, while whale addresses holding between 10000- 100000 BTC performed the worse slumping by 1.74%.

In all, whale and retail investors’ activities show renewed interest in the crypto market following the relief bounce that happened. The renewed interest is a precursor to possibly bullish sentiment in the prices of digital assets.

Furthermore, the ongoing accumulation of Tether also substantiates the bullish market sentiments. If it continues, more funds would be available to flow into the market once it picks a direction. In the meantime, whales continue to wait on the sideline while retail investors continue to buy the dip to ensure they get maximum profit.

Do you think the on-chain activities of whales and retailers are bullish for the overall crypto market? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.