One of Africa’s most recognised crypto platforms launches an investment arm to back fintech and web3 startups worldwide.

Cryptocurrency exchange, Luno recently announced the creation of an early-stage investment arm to support fintech and crypto/web3 firms globally. The subsidiary of Digital Currency Group will leverage on the seven-year experience of its parent company n backing DeFi and Crypto startups. The expansion of its business activities will see it reach more early-stage projects at their pre-seed and seed phases.

Luno Plans To Fund Over 200 Startups Annually

According to the announcement, the Luno Expedition fund does not have a specific size. It plans to support 200-300 businesses every year and eventually expand beyond crypto into the broader fintech market.

Also, the scaling efforts would require a localised approach, especially in the cutthroat world of venture investments. Therefore, Luno Expeditions believes it can use Luno’s market knowledge to help entrepreneurs across all five continents where the company operates.

Consequently, the new investment arm will have an all-female team of five, spearheaded by Jocelyn Cheng. As managing director of Global Innovation Fund, an impact investing VC, Cheng has invested in global startup founders for six years. Her prior positions required her to work closely with Sub-Saharan Africa, India, and Southeast Asia entrepreneurs. She is expected to bring her wealth of experience and skills to Luno Expeditions.

Alongside Cheng, Barry Silbert, CEO of DCG and Marcus Swanepoel, co-founder and CEO of Luno, will be part of Luno Expeditions’ Investment Committee.

The timing of the investment fund coincides with increased retail interest in crypto. Recently, the attention of investors and liquidity providers in crypto, web3, and decentralised initiatives has been on the rise. Firms like Paradigm and Andreessen Horowitz have launched massive funds to back businesses providing solutions in the nascent industry. More funds, including Hack VC, Electric Capital, Crypto.com, and Inflection, have been launched in the last three months.

Consequently, the Luno expedition fund is expected to spend between $50,000 to $250,000 on each startup funded. The investment firm should spend between $15 million and $75 million annually, multiplied by the number of businesses it expects to invest in. The total financial commitments should range between $50 million to $300 million using three to four years of regular investment periods.

New Development Significant For Africa

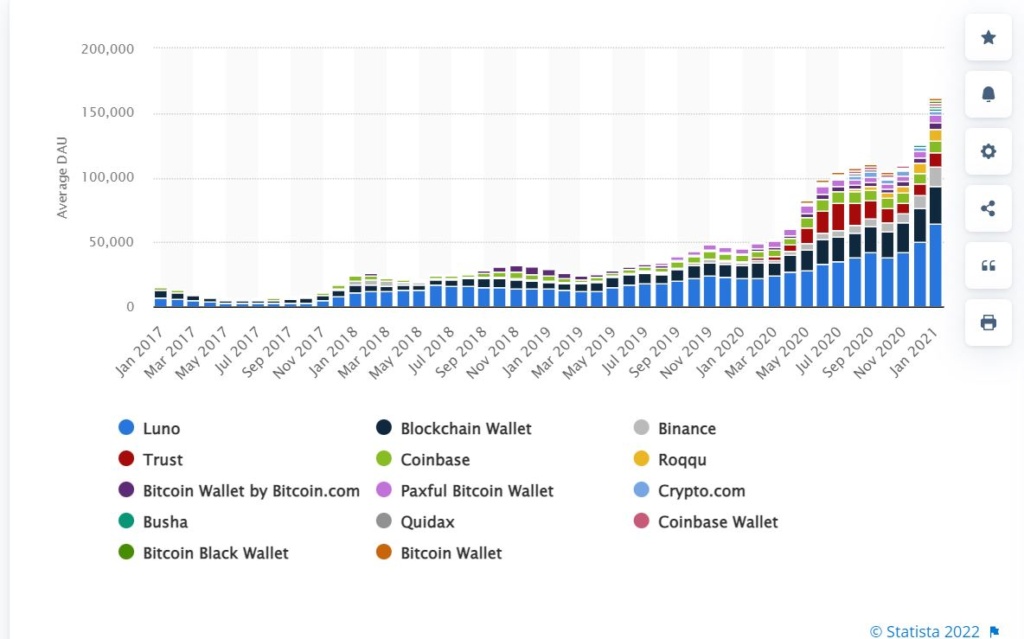

This development is significant for Africa because the continent has remained one of Luno’s primary userbase since its inception. Statista revealed that between January 2017 and January 2021, the crypto exchange held the top spot in the Nigerian crypto market. It beat out the competition of even more recognised platforms like Binance and Coinbase.

Average number of daily active users (DAU) of selected apps that allow for cryptocurrency storage in Nigeria from January 2017 to January 2021 Source: Statista

Luno Expeditions which just emerged from its stealth mode, has invested in 20 crypto and fintech firms in the last few months. These startups include Nala, a Tanzanian remittance solution and Busha, an African crypto exchange. This clearly shows that continent will benefit immensely from the initiative.

Other startups it has invested in include Oraan, a digital bank for Pakistani women, Sealance, an Israeli crypto compliance solution, and fintech company Stitch and Root.

Do you think Luno’s new investment arm will benefit the African crypto and fintech startup space? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.