VISA, BANTU collaboration to reduce interoperability challenges while providing immense economic opportunities for African countries.

Global digital payment leaders, VISA are set to collaborate with Bantu Blockchain foundation, the owners of the Bantu Blockchain network. The partnership will see VISA integrate its digital asset linked cards with the native BANTU utility token XBT. This coalition will provide fast and secure transactions across the ecosystem while directly boosting Africa’s gig economy.

Several African Countries Set To Benefit From Partnership

The alliance is backed by a significant Pan-African bank and a leading Visa banking identification number (BIN) sponsor. It will open up enormous opportunities for increased economic activity in Africa. Zambia, Nigeria, Ghana, Kenya, South Africa, the Democratic Republic of the Congo, Rwanda, and at least six other countries will benefit from the initiative.

Thanks to the Bantu Blockchain, all digital asset transactions are settled in 2-4 seconds and reduced network fees. Further integration with the VISA cards will further increase the ease of transitioning between digital assets and fiat. Furthermore, the Bantu (XBN) Visa cards will be available to all BantuPay users who have validated their identities.

In addition, the Bantu company plans to airdrop about $1billion worth of XBN tokens over the next five years. It further intends to leverage Web3, decentralised apps(DApps), and other blockchain innovations across higher institutions in Africa, Latin America and the USA.

In a bid to foster crypto adoption in Africa, just like Binance and FTX, the partnership will embark on a Practical money skills programme. The endeavour will teach at least 100000 youths every quarter about critical money skills.

Bantu’s COO, Victor Akoma-Philips, reiterated the benefits of the collaboration, highlighting the large-scale positive impact it would have. He said,

At Bantu, we believe that the right technology tools and collaborations applied to the right problem will create large-scale positive social impact. This collaboration with Visa will help create a new Web3 social impact framework

Bantu joins Visa’s Fast Track Program, enabling its fintech partners to innovate and deliver novel experiences on Visa’s payments network. Bantu will be the first blockchain infrastructure in Africa to join this strategic partnership. Speaking about the alliance, Carl Manlan, Visa’s head of social impact for Central and Eastern Europe, the Middle East and Africa, said,

Visa believes that greater financial knowledge can empower people to better manage their money and improve their quality of life. We are delighted to partner with Bantu to help young people learn the fundamentals of personal finance, including budgeting, saving and responsible spending.

Data Suggest Electronic Transaction Volumes Steadily Rising

Fortunately, this new agreement between Bantu and Visa coincides with when electronic transaction volumes rose in Africa. Available data shows that several African countries have seen a tremendous increase in e-transactions made over the years.

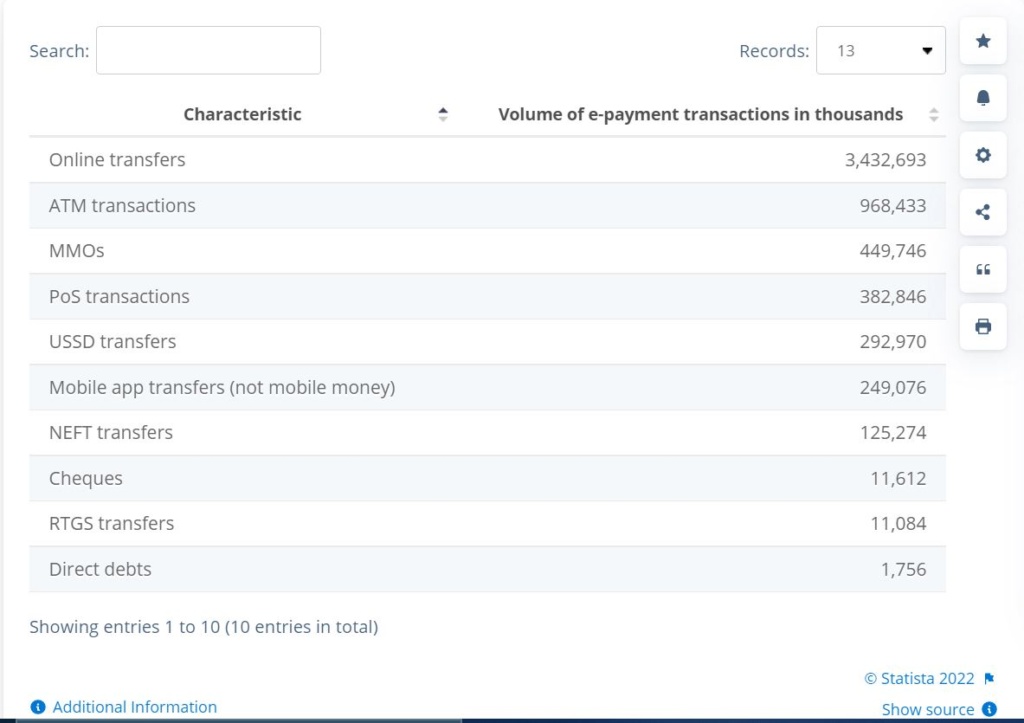

According to Statista, Nigeria had over 3.4 billion e-payments transactions between January and August 2020. The total value of the transactions made over the period exceeded ₦500 trillion.

E-payment transaction volume in Nigeria between January and August 2020, by channel. Source: Statista

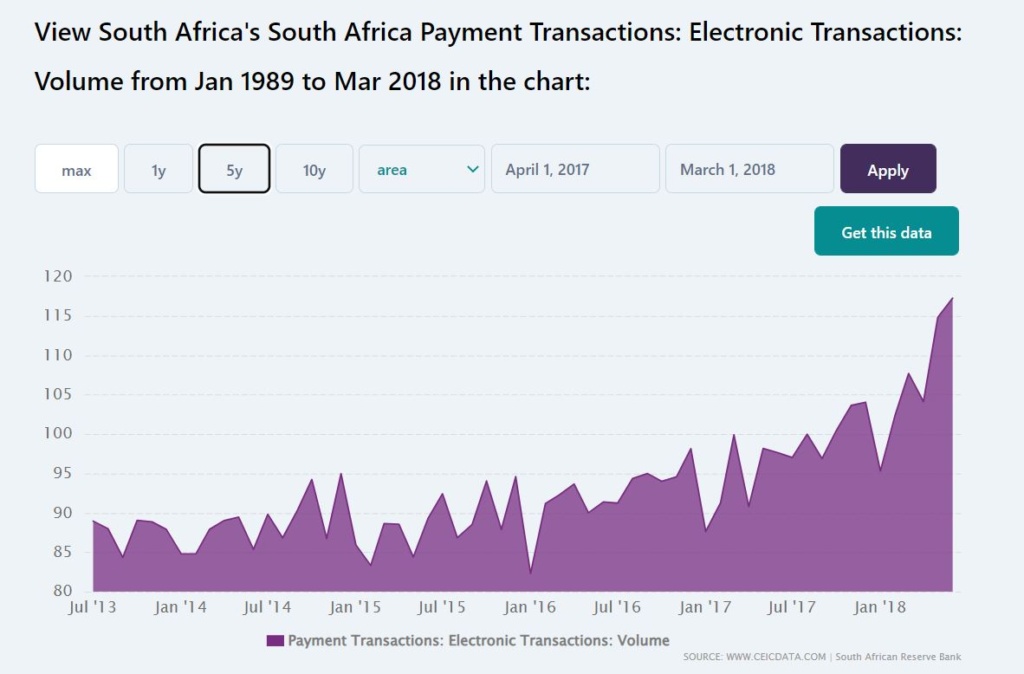

Similarly, South Africa has also seen an increase in e-transactions, according to CIEC data reported by South Africa Reserve Bank. From the chart below, the transaction volume has increased progressively from 90 Unit mn in January 2013 to 117.249 Unit mn in June 2018.

Source: CEIC

The timing of the VISA and Bantu collaboration is happening when more people are turning to electronic payment options. Africans will benefit immensely as the integration provides the best of the payment solutions world and blockchain technology. Likewise, the increased adoption will see both companies grow their reach in the region and further secure themselves as the go-to payment solution provider.

Do you think crypto adoption in Africa will grow furth following the collaboration between Bantu and VISA? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.