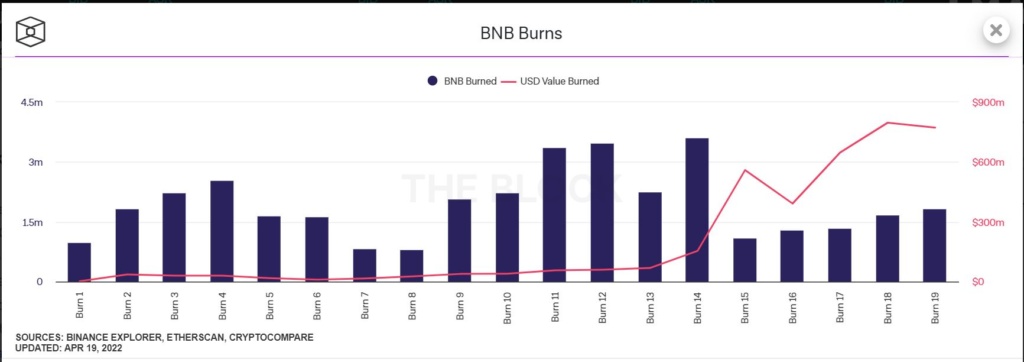

BNB Chain burnt 1,830,382 BNB tokens worth $772 million in its most recent quarterly auto-burn event.

The BNB chain, formerly the Binance Smart Chain, has completed its quarterly auto-burn event for Q1 2022. The event saw 1,830,382 BNB tokens worth around $772 million taken out of circulation.

Source: Theblockcrypto

Following the recent burn, the total number of tokens burned has risen to 34,921,230 BNB. This accounts for nearly 21% of the current circulating supply of 165,078,769 tokens. It also sees the smart contract platform inch closer to its long-term goal of burning 100 million BNB tokens or 50% of its total supply.

BNB Chain Doubles Down On Its Commitment To Remain Deflationary

Since the program’s inception in late 2017, the recent burn is the 19th quarterly event and the second quarterly auto-burn. BNB’s price and the number of blocks produced by the chain over the previous quarter determine the number of destroyed tokens.

Previously, the Binance exchange’s trading volume determined the quantity of BNB tokens burned per quarter. The new auto burn sees the chain double down on its commitment to remain deflationary. Binance’s CEO Changpeg Zhao hinted at the burn, further stating it was part of the platform’s commitment.

In the digital asset space, deflationary mechanisms are implemented to reduce the market supply of a token as time passes. A common way to achieve this is through a token burn. Unlike in traditional finance, where deflation may be bad, in crypto, it is excellent.

Implementing a deflation mechanism usually brings about a supply shock to the tokens in circulation. This has the added benefit of increasing the token’s value, generating profits for investors and removing excess coins in circulation. These advantages have led to several protocols, including Ethereum and BNB chains introducing burn mechanisms to their tokenomics.

Aside from its quarterly burns, the BNB Chain has also introduced a second, real-time burning mechanism, similar to Ethereum’s EIP-1559. This mechanism burns a portion of the BNB spent on gas or transaction fees on the blockchain. Onchain data shows that the BNB Chain has burned over 72,422 BNB valued at roughly $30.5 million in months since its implementation.

Possible Surge In BNB’s Price Expected Following Burn

Following the token burn, traders may be in line to see the value of their BNB holdings increase. BNB’s price has rallied to varying degrees following the quarterly token burn.

Source: Coinmarketcap

Historically, BNB has seen a price surge following the burns. After the fourth quarter burn in 2022, BNB went from $523.16 to $564.62 before prices cooled off. Although not a significant rise, the burn occurred amidst a general decline in digital asset prices.

However, the 17th burn held in September 2021 saw significant growth in BNB’s price. At the burn time, BNB was valued at $410; the price grew over the following weeks reaching $650 in October.

Consequently, investors would be hoping for a similar price run to the Q3 2021 price rally after this burn. This would ensure that they get a significant return on their BNB investments.

Do you think BNB’s price will rally significantly over the following weeks? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.