Uganda’s apex financial institution may soon join the growing list of African countries launching their digital currency.

The Bank of Uganda (BoU) delegated officials to learn how to establish its own digital currency from Nigeria. The Nigerian central bank governor, Godwin Emefiele, welcomed the representatives. The bank expressed this in a tweet from its official handle.

Nigeria Tutors Uganda On Its CBDC Adventure

In March, Uganda had expressed intentions to explore the central bank digital currency (CBDC). According to the BoU’s Executive Director of Operations, Charles Abuka, they were still investigating the need to embark on a CBDC adoption. The BoU needed the exercise to ascertain the implications of adopting an e-currency. This visit to Nigeria appears to be an endeavour to grasp how the fait-based currency could aid the country.

“First is to establish properly what is the rationale, why must we have it, and what issues is it going to help us resolve.” Mr Abuka said.

The Ugandan lead bank seems attracted to the speed of transaction that CBDCs promise, as some experts have highlighted. Also, the transition from an expensive cash economy has served as another reason that may necessitate this move to adopt digital currencies. This is because maintaining e-currencies will be a lot cheaper. Ugandan regulators are hesitant to phase out the existing fiat system due to fear of cutting off the rural communities.

According to the Nigerian CBN Governor, the eNaira—which is the Nigerian digital currency— would be integrated into the country’s goal of achieving financial inclusion. He said this while addressing the Ugandan delegates, adding that he believes Uganda could benefit from replicating this process.

Emefiele also mentioned the need for enhancing the synergy between mobile banking and online businesses. He was careful to note that this process shouldn’t happen without caution.

More African Countries Join With Nigeria’s Lead

The Central Bank of Nigeria has secured its lead as the first African country to launch its e-currency successfully. The country’s apex bank intends to achieve organic adoption among citizens. This effort has developed into aggressive marketing since its launch. According to an earlier report, the bank had embarked on a sensitization activity for the eNaira. The marketing exercise was geared towards enticing businesses to embrace the naira-pegged digital currency.

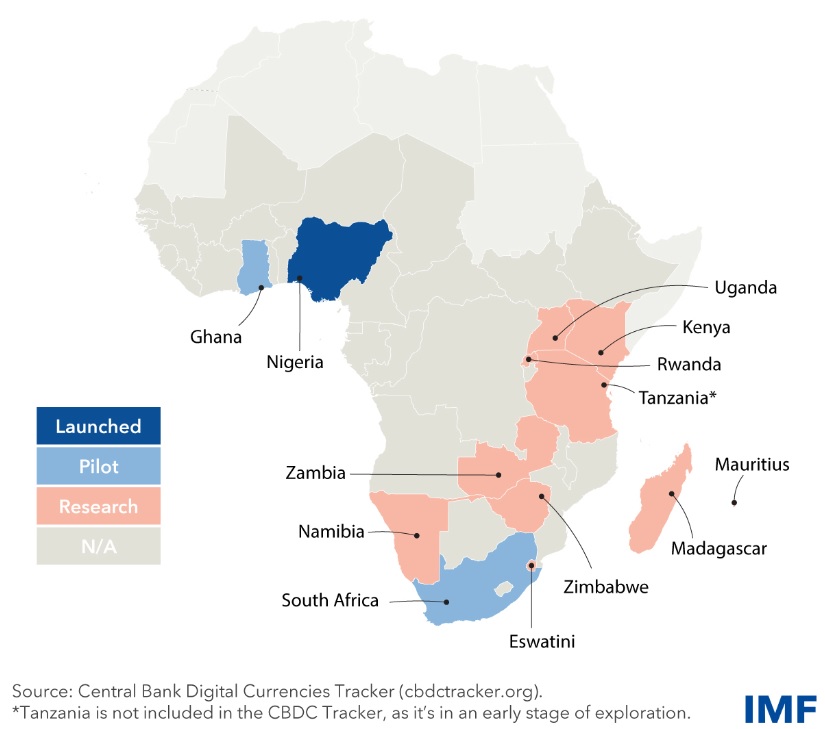

Africa’s CBDC Tracker. Source: IMF

A report from the International Monetary Fund (IMF) shows that Uganda is not the only African country looking to digitize its local currency. Many financial institutions within sub-Saharan Africa are either considering or have reached a digital currency pilot phase. Meanwhile, Nigeria leads the pack in Africa and is already set for an upgrade. The west African country trailed the steps of the Bahamas, making them second in the world.

The graphical illustration reveals that most African countries are yet to consider creating a digital currency. Of the 54 countries on the continent, only 13 have earned a spot on the map in this regard. South Africa and Ghana are already on track to joining Nigeria as they have reached the pilot phase. Meanwhile, the other ten regions, including Uganda, are still in their research phase.

Do you think more African countries will join the CBDC adoption? Let us know your thoughts in the comment section below.

Kingsley is a fintech writer with over 4 years of experience covering blockchain and cryptocurrency news. Alo first discovered Bitcoin in 2016 and has been passionate about it ever since, particularly the various ways blockchain can help Africa and the world at large. He desires to give the crypto space a more geographically balanced narrative and serve as a bridge between Africa and the rest of the world. His articles have been featured in Cointelegraph, Beincrypto, and Forkast.news, among others.