Mixers see increased usage in the first quarter of 2022 as a record $52 Million worth of digital assets passed through them.

Undoubtedly, the problem of fraud, especially money laundry within the crypto industry, continues to be significant. Although there is a considerable push to tackle the issues, emerging reports suggest more still needs to be done.

According to Chainalysis, money launderers have increasingly turned to mixing services more than ever in 2022. The blockchain data platform revealed that the 30-day moving average for mixer inflows reached an all-time high of $52 million in Q1 2022. The current amount doubles the income volumes recorded a year ago.

Mixers Are A Crypto Concern

Although a major concern, the growing use of mixers for money laundry activities is not new. Its use has continued to be a significant issue for government agencies in charge of financial security even as the digital assets space expands.

Crypto mixers or tumblers allow ther users to anonymize fund transfers between services that do not require Know Your Customer (KYC) checks. By blending potentially traceable cryptocurrency funds with substantial amounts of other funds, many users utilize mixers to keep their crypto transactions hidden.

As a result, mixers, much like online gambling sites, have become suitable for money laundering activities. According to research, tumblers process roughly 25% of all illicit Bitcoin each year.

Mixers are programs that work by combining a specific amount of cryptocurrency in private pools before sending it to the intended recipients. A Bitcoin explorer, for instance, will display that person A deposited Bitcoin to a mixer and that person B received Bitcoin from a mixer. This prevents anyone from knowing who sent BTC to whom. As a result, during the cryptocurrency mixing process, dirty Bitcoin gets washed.

The legality of using crypto mixers to disguise crypto transactions is jurisdictional. While they continue to see growing adoption by miscreants, they also offer the benefit of anonymity which make digital asset appealing to ordinary people.

However, the Financial Crimes Enforcement Network (FinCEN) in the US has clarified that mixers are money transmitters under the Bank Secrecy Act (BSA). Therefore, they must register with FinCEN, and create, implement, and maintain an anti-money laundering compliance program. Furthermore, they must adhere to all relevant reporting and recordkeeping requirements.

Mixers Now The Go-To For Cyber Criminals In 2022

Source: Chainalysis

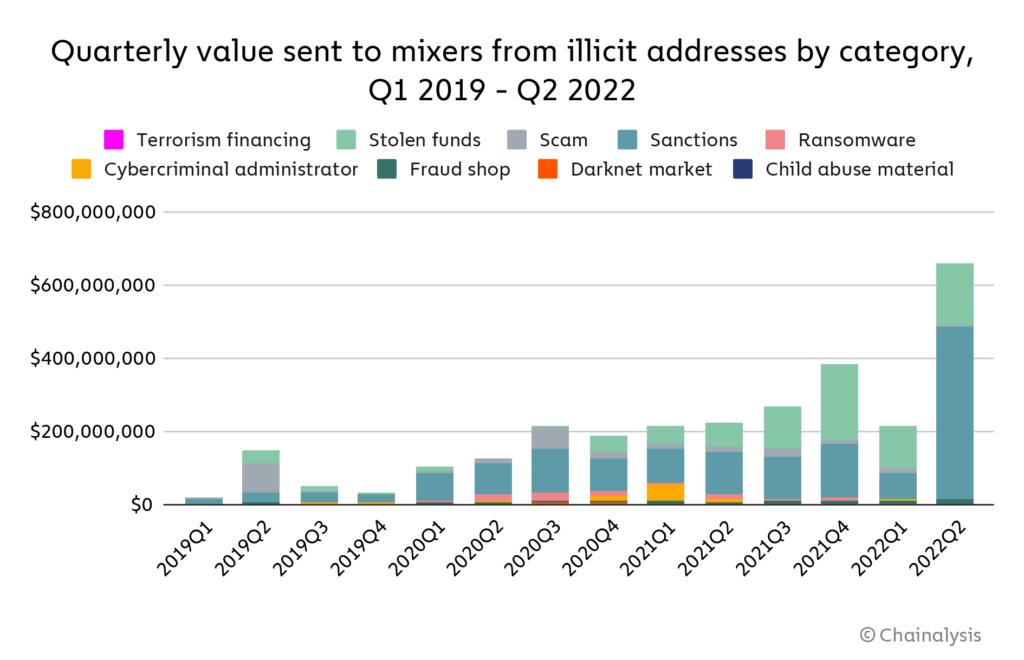

Data from Chainalysis show that mixers have continued to receive more cryptocurrency than ever in 2022. The chart shows that nearly 10% of all funds sent from illicit addresses are sent to mixers. Other avenues were barely able to surpass 0.3% of these funds. Furthermore, there has been a quarter-on-quarter increase in funds sent to mixers since 2020. However, while the growth has stalled, it has remained close to all-time highs.

Source: Chainalysis

The chart above shows that the volume increases sent from centralized exchanges, DeFi protocols, and addresses linked to illegal activity account for most of the increases. The time frame has coincided with the significant prominence of DeFi within the digital asset space.

Source: Chainalysis

Finally, the increase in illicit cryptocurrency moving to mixers is intriguing. Illegal addresses account for 23% of funds sent to mixers in 2022, up from 12% in 2021. A closer inspection of the data suggests that a large volume of the funds moving to mixers are from entities that have been sanctioned. In 2022, that has been even more significant.

Do you think crypto mixers should be prohibited due to their increasing use for illicit activities despite their advantages? Let us know your thoughts in the comments section.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.