Crypto juggernauts are recording new lows in mining fees as the market shakeout continues to dampen interest.

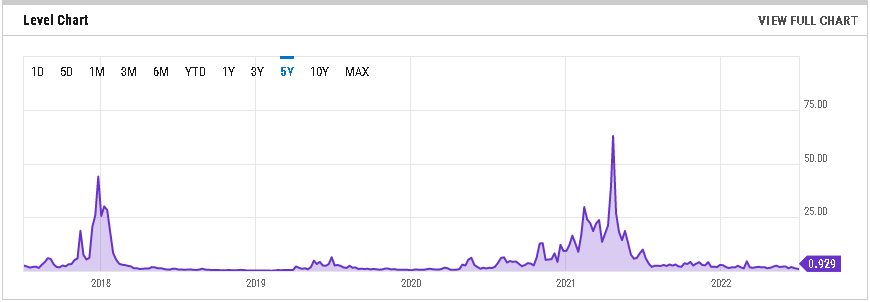

For the first time since 2020, Bitcoin and Ethereum transaction fees have dropped below $1 and $2, respectively. As the crypto market’s shakeout continues, the mining fees for digital assets are also recording new lows. Surprisingly, The average transaction fee per Bitcoin (BTC) transaction made a complete 360-degree over nearly two years settling at around $0.9, r which was last recorded back in June 2020.

Bitcoin average transaction fees. Source: Y charts

Mining Fees Fall To New Levels

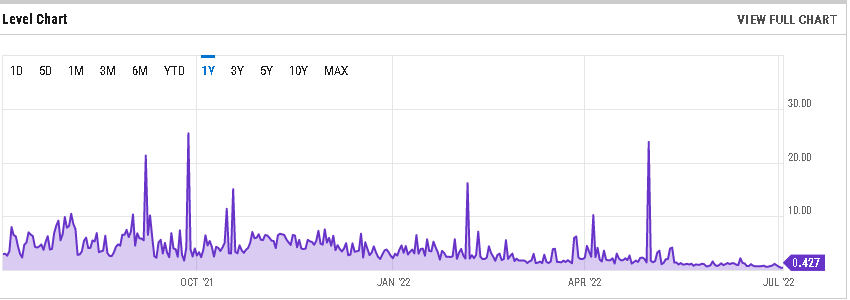

Ethereum’s (ETH) transaction fee has also been on a free fall and is currently at $0.4, down from the $3.20 seen last week. However, in ETH’s case, the current level is still higher than the $0.17 recorded on 17 May 2020, during the great crypto crash.

Ethereum average transaction fees. Source: Y charts

The current downslide in BTC and ETH transaction fees can be attributed to a couple of reasons. Firstly, with the market in a free fall, the number of transactions has also gone down sharply. Secondly, a large number of miners have shut down their shops due to the unprofitability of mining operations.

As per data source Glassnode, around 15% of Bitcoin’s hash rate has gone offline in the past week as BTC’s price tanked below $40,000. The drop in hash rate has led to a sharp decline in difficulty, which is now down by 16%. A lower difficulty means that more blocks can be mined with the same hash rate; hence, miners need to deploy less computational power to earn rewards.

This isn’t just a bitcoin phenomenon either, as other digital assets are also seeing their transaction fees plummet. For instance, Litecoin’s (LTC) transaction fee has also recorded a new low of $0.29 after peaking at $1.40 on May 11.

The decline in transaction fees is yet another sign of the cooling interest in cryptocurrencies as prices have stagnated over the past few months. However, it’s worth noting that even at these lower levels, crypto transaction fees are still significantly lower than those seen for traditional payment methods like credit cards or PayPal.

Bitcoin’s Falling Hash Rate Exacerbates The Situation

This development may not be far-fetched from the dwindling hash rate caused by the plummeting interest in mining activities as well. The hash rate is a measure of the computational power used to mine cryptocurrencies and has also been on the decline since reaching an all-time high in early May.

The current market conditions have led to many miners shutting down their operations as they are no longer profitable. This is likely to lead to a further decline in hash rate and transaction fees in the near future. However, it is worth noting that these lows are still significantly higher when compared to the levels seen during the 2017 bull run.

There may be a possibility of an end to the bear market if the transaction fees begin to recover along with an increase in the hash rate. However, for now, it seems that the market is still in a slump, and interest in cryptocurrencies appears to be waning. This could mean that fees will remain low for some time to come.

It is also important to note that this is not the first time transaction fees have declined during a bear market. In fact, during the 2020 bear market, fees also dropped to all-time lows as investors abandoned ship. However, the market eventually recovered and fees began to rise once again.

So far, the decline in transaction fees has not been accompanied by a significant increase in the number of unconfirmed transactions, which suggests that demand for Bitcoin and other cryptocurrencies has indeed declined.

Do you think mining fees will take another two years to hit new highs? Let us know your thoughts in the comment section down below.

Kingsley is a fintech writer with over 4 years of experience covering blockchain and cryptocurrency news. Alo first discovered Bitcoin in 2016 and has been passionate about it ever since, particularly the various ways blockchain can help Africa and the world at large. He desires to give the crypto space a more geographically balanced narrative and serve as a bridge between Africa and the rest of the world. His articles have been featured in Cointelegraph, Beincrypto, and Forkast.news, among others.