Crypto Market cap surges to $2 trillion as Stock also post gains following positive discussion between Russia and Ukraine over the ongoing conflict in Europe.

Just yesterday, Russia vowed to reduce military operations around Kyiv and another city following a breakthrough in peace talks. The ongoing crisis has lasted for over a month, claiming thousands’ lives and seeing about 4 million displaced. The discussions held in Istanbul’s palace also saw Ukraine adopt a neutral status as a symbol of progress in face-to-face talks.

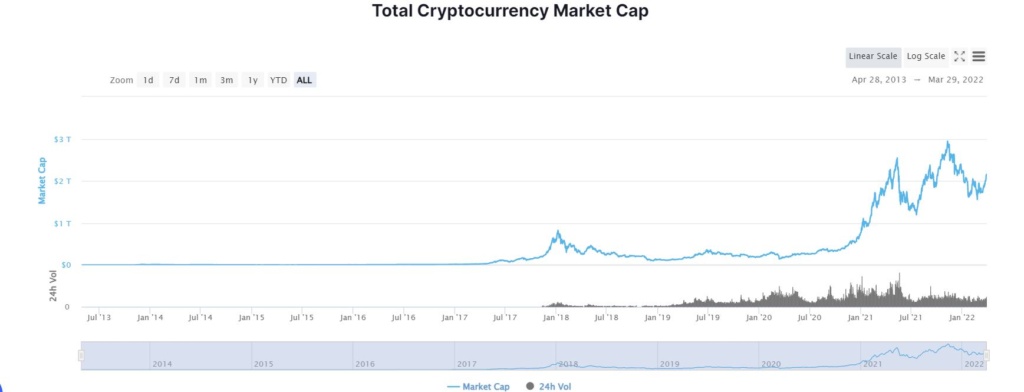

With a cease-fire and possible end to the conflict on the cards, both the crypto and stock markets reacted positively. Both financial tools which the crisis has heavily impacted saw relief bounces. According to Coinmarketcap, the total market cap of crypto surpassed the $2 trillion mark, proving itself resilient to ongoing global instability.

Source: Coinmarketcap

Bitcoin Leads The Way As Q1 2022 Ends Positively For Crypto

Following a relatively underwhelming three months, the crypto market appears to have the wind in its sails as the first quarter concludes. The strong performance has been led by Bitcoin, which has performed remarkably over the last week.

However, following the announcement of peace talks, the already weakening Bitcoin price surpassed the $48,000 mark. The move saw the digital asset invalidate the $34,000- $44,000 range it had traded in for most of 2022.

Bitcoin has remained relatively steady despite growing global inflation and other macro winds that have affected the financial market. According to the futures trading site Coinglass, its 30-day volatility is around 3.21%, significantly lower than the 4.56% recorded on March 16. The current value is still two-thirds the value recorded in June 2021. This shows that bItcoin continues to have wild swings in price but not up to the levels recorded in 2021.

Other digital assets have followed suit, with Bitcoin posting significant gains, causing the total market cap to hit $2 trillion. According to Coinmarketcap, Bitcoin’s impressive market valuation is $902 billion. However, it is a long way off the $1 trillion it held in November. Despite being the most popular cryptocurrency, its market share has steadily decreased from almost 70% in early 2021 to barely 42% today.

The Slow grind back to $2 trillion has been aided significantly by the boom in new digital assets. According to Coinmarketcap, over 5000 new digital assets have been added to the space since November. This has brought the total number of crypto assets to over 18500. In the last week, digital assets such as Ethereum, Terra, Cardano, Dogecoin, and Shib have all seen double-digit rises. Essentially, the entire space is being pushed to retake higher ground.

Stock Market Rallies Too

The stock market was not also left out as it posted positive gains following the announcement of a possible cease-fire. US market indices surged over 1%, while Europe’s key bourses gained between 1% and 2.5%. However, oil fell close to $5 at one time.

Chart showing US Stock Indices. Source: YahooFinance

The chart above shows that the Dow Jones Industrial Average rose 0.97%. The S&P 500 gained 1.23%, while the Nasdaq Composite surged by 1.8%. This gain further bolsters claims that cryptocurrency has decoupled from stocks.

With the possibility of a cease-fire and end to the conflict in sight, investors may find this period suitable for taking a position in the market. This will enable them to reap significant gains if the market continues its upward surge.

Do you think the end of the conflict in Europe will further impact the financial markets significantly? Let us know your thoughts in the comment below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.