Despite becoming the majority shareholder of popular microblogging platform Twitter with a 9.2% stake, Elon Musk remains on the sidelines.

Elon Musk, the world’s richest man, has decided against joining Twitter’s board following his 9.2% purchase of the company. Twitter’s CEO, Parag Agrawal, revealed his decision, having earlier announced Musk would join the board following the acquisition.

Despite Musk’s refusal, Agrawal has reiterated that Twitter remains open to the input of its largest shareholder.

Musk’s Decision Leaves Door For Potential Future Purchase Of Twitter

Speculation over why Musk decided to reject a sit on Twitter’s board has been rife since the announcement. However, reports suggest that his choice allows him to fully acquire the microblogging platform if he decides to go that route.

According to the Security and Exchange Commission filings signed by Musk, a board seat would limit him to buying just 14.9% of Twitter. However, Musk can buy as much Twitter stock as he wants now that he isn’t on the board of directors. That means he may try to buy the company if he so desires.

The sentiment is supported further by Wedbush analyst Dan Ives, who believes the move could signal a more aggressive approach to purchasing Twitter. He further said that there was a good chance Elon could increase his active ownership in the firm.

“This now goes from a Cinderella story with Musk joining the Twitter board and keeping his stake under 14.9%, helping move Twitter strategically forward, to likely a Game of Thrones battle between Musk and Twitter,”

Another mooted reason for the decision may be the possible constraining of Musk’s ability to tweet freely. An ardent Twitter user, the world’s richest man has over $80 million followers, whom he regularly interacts with on the platform. By rejecting a board seat, Musk will likely have greater freedom to pressure twitter for changes publicly.

It seems he has wasted no time in hinting at possible changes that may come to the platform. In a now-deleted tweet, Musk suggested that subscribers of Twitter blue should pay with dogecoin. He further suggested the removal of ads and the reduction of the subscription fee. Twitter has also rode the wave of euphoria, announcing the introduction of the edit button. An update that over 300 million users have clamoured for since the platform’s existence.

Twitter Stock Crashes Amid Backlash From Critics

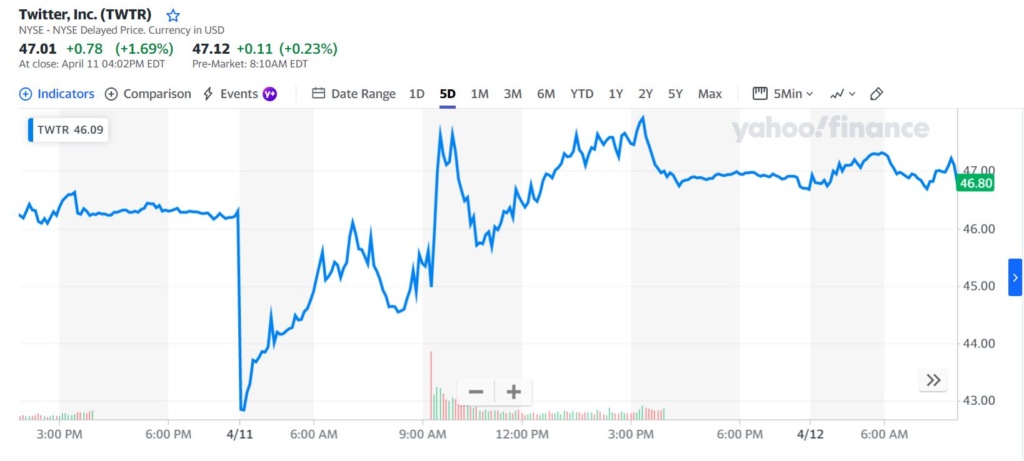

Immediately after Agrawal’s announcement, twitters stock prices slumped slightly before recovering and ending the day 2% higher. However, the share price has fallen again from $47.92 to $ $46.80. This may mean that it would take more than positive sentiments from the world’s richest man to spark a steady rally in share price.

Source: Yahoo Finance

Musk, a controversial figure, has also riled up critics with his purchase and possible stance on Twitter. Anil Dash, Glitch’s CEO, took to Twitter to lambast the possibility of Musk sitting on Twitter’s board. He called the move bad and wished that the platform had added active users and developers of healthy communities to its board.

He further called out Twitter for wanting to appoint someone who broke a federal law using their products to their board. He then pointed out that Musk could use his position to attack journalists and critics without any repercussions.

His tirade further proves that not everyone is on board with Musk’s new acquisition. However, many hope that the values of free speech which the platform upholds would continue while necessary improvements would be brought forward.

Do you think rejecting a board seat on Twitter was a good decision by Elon Musk? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.