With US inflation at levels not seen in the last four decades, developing economies like Nigeria are negatively impacted.

According to former Twitter CEO Jack Dorsey, the repercussions of US currency inflation are being felt badly by Nigeria and other developing countries. He made the statement in response to the effects of the US Federal Reserve’s dollar printing in recent years. This comes following the strong performance of the Bloomberg Dollar Spot Index, which hit its highest levels since 2020.

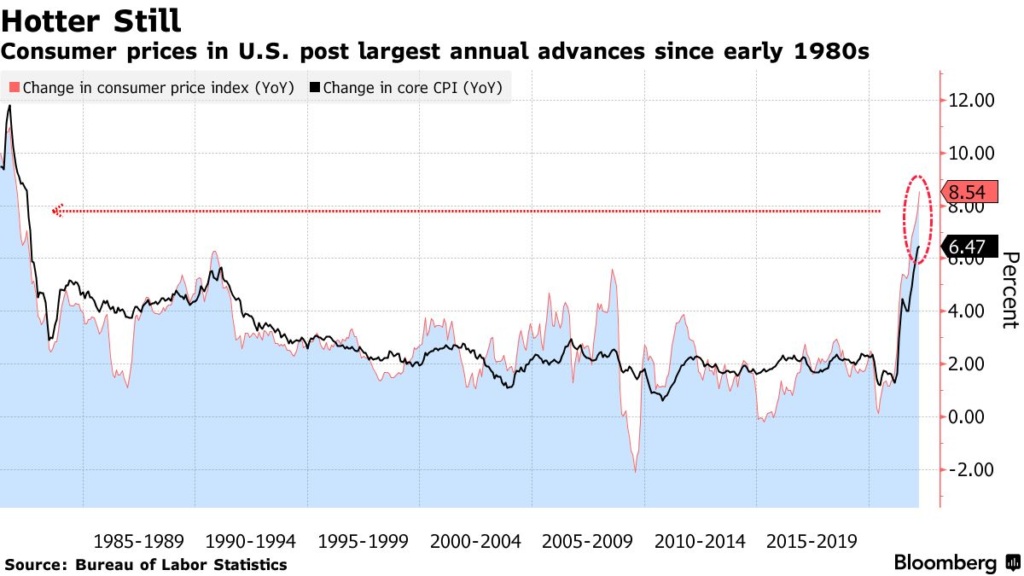

US Inflation Hits 40-Year High

The Bureau of Labor Statistics (BLS) recently released its vital consumer inflation data. Its findings revealed that inflation in the United States reached 8.5% in March. This value is the highest on record since 1981.

Source: Bloomberg

According to the data, the consumer price index jumped 8.5% from a year ago, following a 7.9% annual growth in February. The closely watched inflation indicator increased by 1.2% from a month before, the most significant increase since 2005.

Consequently, like Dorsey, several analysts have expressed concern over the effects of inflation on citizens. Anthony Pompliano, in his Pomp letter, went to great lengths to explain the reality of the situation to everyday Americas.

He believes that despite the 8.5% figure being bandied around, most Americans are experiencing double-digit inflation. He pointed out that data from the decentralised inflation dashboard Trueflation, which has US Inflation at 13.8%, is closer to reality. He further called out the white house for playing on the intelligence of its citizens by not taking full responsibility for the economic situation.

Furthermore, Pompliano accused politicians of not being incentivised to tackle the issue. Instead, they are focused on how to pass the right message since they and other wealthy individuals are not feeling the effects. He even suggested that the Federal reserves have run out of ammunition to tackle the issue without sending the US and other economies into recession. Hence, the average American has no other option than just to survive.

Inflation Impact On Developing Economies

Echoing the sentiments of Jack Dorsey, emerging economies simply have their fates tied to policies regarding the dollars amidst growing inflation. To curb inflation, the US Federal Reserve has planned several interest rate hikes across 2022. However, the international monetary fund (IMF) has expressed concern over the hike’s impact on developing economies.

The resultant effect would be a corresponding increase in inflation and a slowing down of economic activities in these countries. This is because these budding markets are usually reliant on the dollar to purchase needed imports. Hence, the rising cost of goods coupled with their high debt obligations and forex exposure leaves them vulnerable.

Although not generally accepted, Bitcoin can play a significant part in reducing the impact on developing countries. Several analysts, including Dylan Leclair, have suggested its use to help insulate against the effects of inflation globally.

Without a doubt, developing economies have their fates tied to the US dollars. Therefore, the US government must make policies that do not jeopardise their economy and those of other reliant countries. On their part, countries like Nigeria need to reduce their reliance on the US dollar, converting themselves from an import-based economy to an export-based one. Also, they can explore the use of digital assets further to insulate themselves from the adverse effects of inflation.

Do you think developing economies are adversely affected by rising inflation in the US? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.