Amidst growing inflation rates and the depreciating Naira value, the lower arm of Nigeria’s National assembly wants the CBN to reinforce the use of coins.

Yesterday, the Nigerian house of representatives urged the Central bank of Nigeria (CBN ) to strengthen the use of coins as legal tender. The resolution came through a motion proposed by Rep. Muda Umar. The legislative arm further urged the apex bank to ensure that money deposit banks comply fully with the directive.

Clamour For Coins Confusing Considering The Naira’s State

The call for the reinforcement of coins by the legislative arm of government is somewhat bizarre considering the state of the Naira. Experts allege that the neglect of lower denominations that form the bulk of existing coins is due to Naira’s depreciation and rising inflation.

According to data provided by the CBN, the current inflation rate in Nigeria as of February 2022 stands at over 15%. This statistic is especially damning because the average cost of goods and services is rising. The effect on the citizenry is a reduction of their purchasing power, thereby causing little or no need for lower denominations.

Five naira, which is currently the country’s lowest denomination among the notes, has been tagged “valueless” by Nigerians. This has been attributed to the poor monetary policies within the region and builds a stronger case for the needless cause of reinforcing the use of coins.

Therefore, it is safe to say that it minting low denominations of the naira has become counter-productive. According to Professor Ken Ife, Chief Economic Strategist in ECOWAS Commission, Nigeria spends nearly $200 million printing money yearly. This cost does not cover the minting of coins. This highest cost and relative irrelevance of coins within Nigeria make the legislature’s decision more baffling.

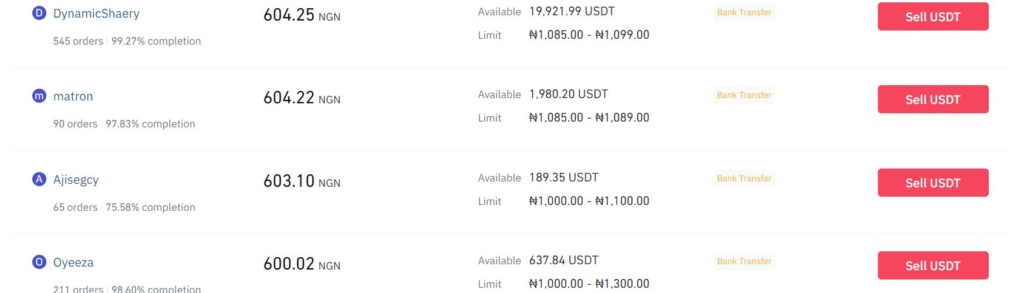

Consequently, the tightening economic situation and shortage of Forex has continued to see the Naira depreciate further. The Binance peer-to-peer market, corroborates this worsening FX condition of the country as a dollar trades for over ₦600, while the average purchase cost is ₦583 at the time of this report.

Source: Binance

Fears Persist Over Forex Scarcity

With election activities set to commence in earnest, there are fears that the Forex scarcity will become uglier. The CBN stopped the sale of forex to the Bureau De Change and promised to boost liquidity to the commercial banks. These banks have also capped online monthly transactions at $20, further limiting customers’ access to forex.

With drastic measures to address the Forex issue, many believe there will be further loss of jobs, especially in the manufacturing industry. Also, economists say that this crisis would worsen inflation and negatively affect the country’s Gross Domestic Product.

This dire situation may be the reason for Nigerians turning to digital assets to hedge against inflation and seek forex. Statistics from LocalBitcoins reveals that the volume of crypto transactions has reached a new high since the beginning of the year. The chart below shows that the transaction volume surpassed ₦500 million in the last week as citizens desperately seek better alternatives.

Source: Coindance

Consequently, it is important that the government pays more attention to the economy and proffer solutions to the growing inflation and scarce Forex. Focusing on the issuance and use of coins with little or no purchasing power seems like a waste of time in the face of more pressing challenges. For now, citizens can only hope that the government acts quickly, or else more gloomy days would persist.

Do you think coins have a place in the current Nigerian financial structure? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.