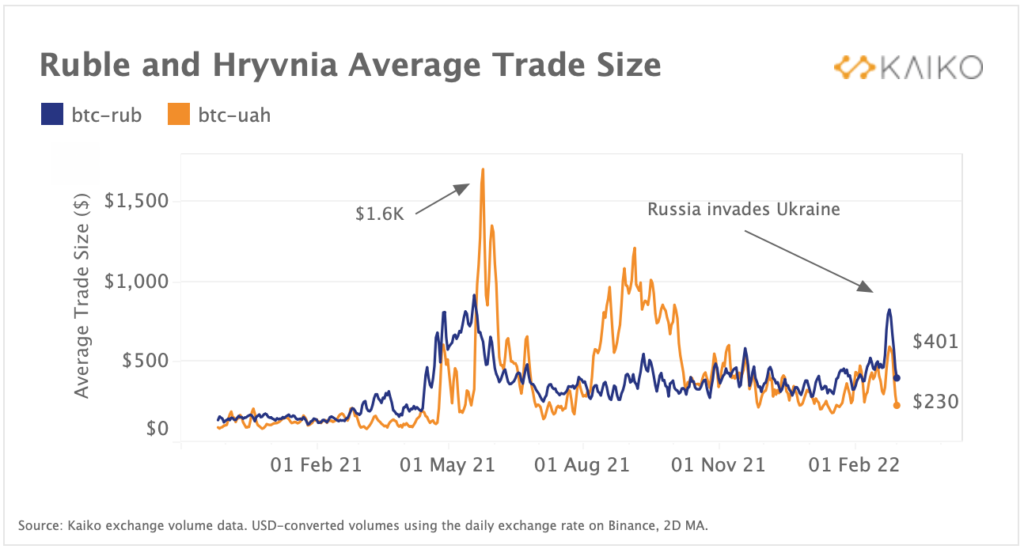

Since the invasion commenced, the Russian and Ukrainian national currencies recorded significant surges in their BTC trading pairs.

The embattled citizens of Russia and Ukraine have turned to cryptocurrencies even as economic uncertainties persist. The current demand for digital assets has caused a spike in the crypto trading volume of both the Ruble and the Hryvnia. This surge in trade size is boosted by the record devaluation of both currencies and market disruption caused by the Russia-Ukraine crisis.

Source: Kaiko

The chart above shows the increased trading volume in both currencies’ respective BTC trade pairs. Of the two pairs, the BTC-RUB had the more pronounced surge, with its average trade size hitting ten months high amidst war. It went as high as $830 before falling to $401.

For the BTC-UAC, its average trade size increased to $580, up from $250 in January. This on-chain data points to retail accumulation driving up the trade volumes for both currencies.

Fiats Crucial To Crypto On-Ramp

The increased trading volume in both currency pairs has highlighted the importance of fiat currencies to the crypto markets. They act as crucial on-ramps that allow crypto investors to trade cryptocurrencies conveniently.

Several centralised crypto exchanges (CEX) offer fiat currency pairs but are restricted by the currency’s jurisdiction regulations. Despite these impediments, these platforms frequently operate globally, albeit with limited services. Coinbase, for example, only supports three fiat currencies but operates in over 100 countries.

In certain countries, CEXs only allow traders to trade crypto for crypto. Meanwhile, in others, investors can only buy crypto with a credit card and not cash out into a bank account. Finally, traders in areas where bitcoin services are unavailable may find it challenging to access the crypto markets.

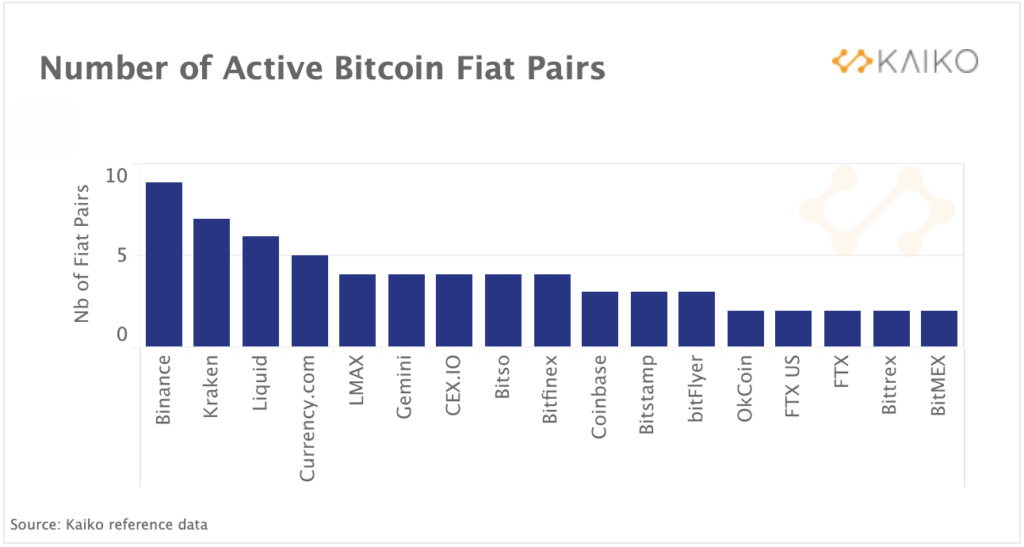

Source: Kaiko

Among all the CEXs, Binance offers the most fiat currency with eight. Kraken comes in second place by providing seven while Liquid wraps up the top three. The offering on Binance has seen the exchange play a crucial role in the ongoing invasion of Ukraine. With Ruble and Hryvnia among the fiat currency offered by Binance, the platform has seen become the go-to for citizens of both Ukraine and Russia.

Strict Policies Restrict Trade Volume Of Hard Currencies

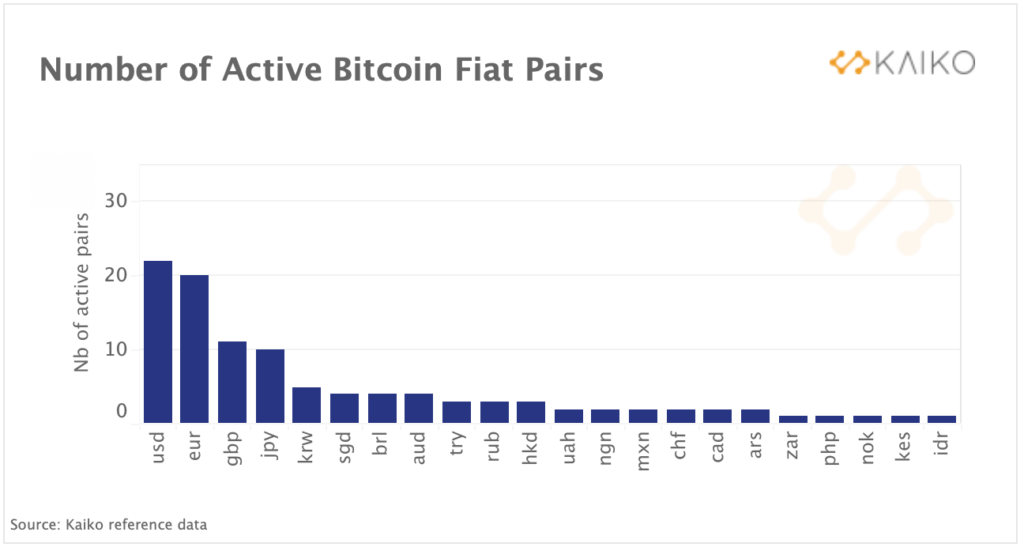

On-chain data shows that strict regional rules have limited trade volumes of hard currencies. This has increased the importance of fiat-pegged stablecoins, which link fiat and crypto-assets. However, the USD, EUR and GBP are the most popular quote assets. They are also believed to remain more stable and operate as a liquid store of value in times of market volatility.

Source: Kaiko

Above, we can see the number of active bitcoin-fiat trading pairs across more than 100 exchanges. The USD, EUR and GBP live up to their reputation and are the only fiat currencies provided by more than ten exchanges. The JPY is offered by ten while all the others have five or less.

The ongoing Russia-Ukraine war has drawn global attention to the place of cryptocurrency in modern finance. It has also caused a shift in awareness on social media, with war and crypto-related topics seeing massive spikes. However, removing fiat currency restrictions would facilitate more people to access the crypto market easily. Hopefully, governments watching ongoing events would start taking a soft stance regarding the space and enact better laws to ensure easier on-ramp.

Do you think more fiat currencies should be added to exchanges to ensure easier on-ramp? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.