The race for dominance and widespread adoption continues to heat up within smart contract platforms in crypto.

The evolution, growth and adoption of crypto have led to a fierce battle among smart contract platforms and ecosystems in the space. Due to scalability issues, developers continue to build alternative blockchains to Ethereum—the smart contract king. These problems have resulted in network congestion and high transaction fees, which have hindered more investors from participating actively.

New Players Challenge Ethereum’s Dominance

Ethereum’s previous utter dominance of the crypto contract scene seems to erode constantly as new blockchains emerge. These alternatives offer increased throughputs and lower transaction fees that make them appealing to both traders and developers alike. This has seen them slice off a decent market share from the leading smart contract platform.

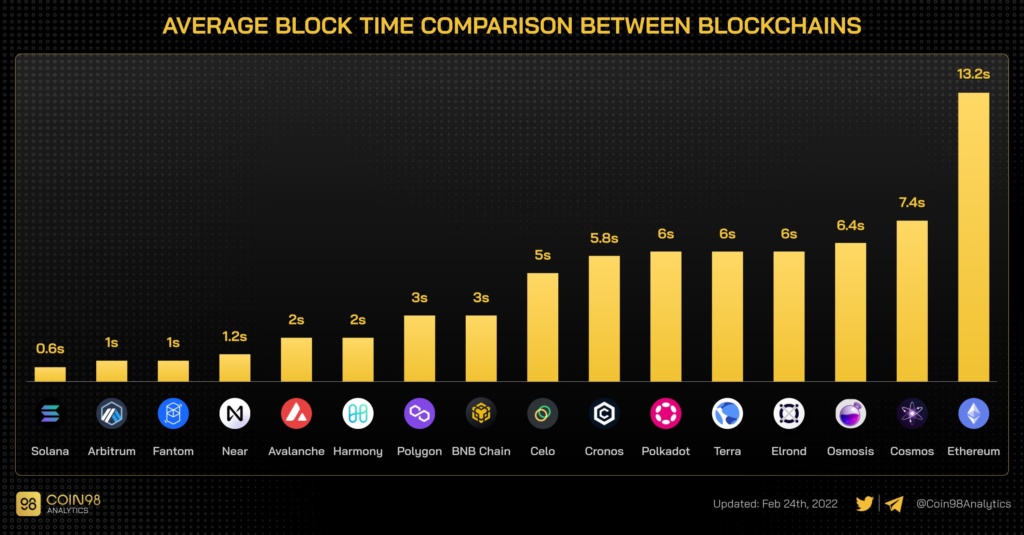

Data compiled by Coin98 analytics has revealed that Ethereum has the highest average block time with 13.2 secs among programable blockchains. This is nearly double the value of the next ecosystem Cosmos with 7.2 secs as its average block time.

Source: Coin98 Analytics

The mean block time across the seventeen blockchains is 4.09 seconds, with eight sitting above this average. The average is heavily influenced by the block time of Solana, Arbitrum and Fantom with a value of 1 second or lower.

Another exciting aspect of the chart is the emergence of Layer 2(L2) scaling solutions competing alongside Layer 1s. Arbitrum and zkSync are examples of L2 mechanisms deployed on the Ethereum blockchain to help reduce congestion and gas fees. They both seem to be carrying out their tasks effectively.

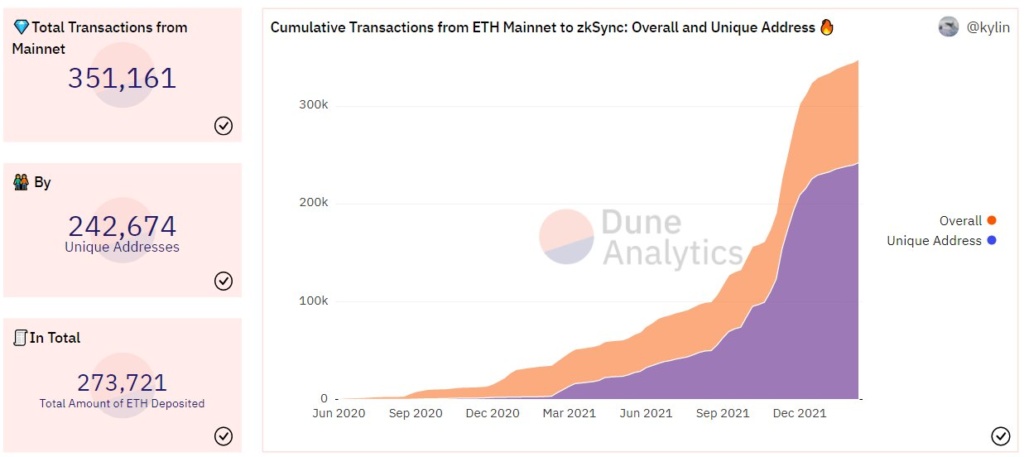

Consequently, according to Dune Analytics, there has been a steady growth in cumulative transactions from the Ethereum mainnet to L2 options. Since 2020, the number of ETH deposited in the zkSync L2 network has grown and now exceeds 90,000. Also, there have been more tha 350,000 deposit transfers from the mainnet with roughly 240000 independent addresses.

Source: Dune Analytics

This data further corroborates the notion that users are increasingly seeking Ethereum alternatives, with L2 options increasingly favoured.

Solana’s Advantages Prefered

The Solana blockchain has become the preferred choice for users due to its obvious advantages of reduced cost and increased speed. The previous chart shows that the smart contract platform offers the fastest average block time among the numerous Ethereum alternatives.

The Solana blockchain has been designed specifically for the development of highly scalable and user-friendly Dapps. Not only is it the fastest L1, but it is also one of the most efficient ecosystems available, offering over 400 DeFi, NFT and web3 applications. This has led to an influx of developers onto the platform to build protocols for its increasing users.

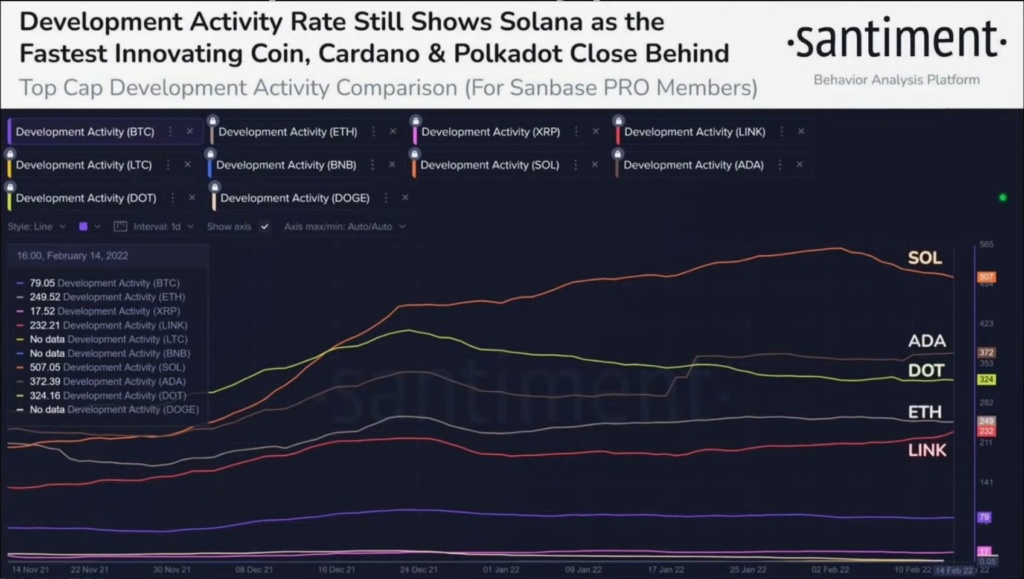

The preference for Solana is backed up by data from Santiment, which shows that it has overtaken Ethereum in the number of active developers. It also leads all other blockchains in development activity rate, thereby holding the title of the fastest innovative chain.

Source: Santiment

Besides being faster and more efficient, Ethereum’s high gas fees have played a significant role in Solana’s ascendance as a viable Ethereum killer. However, it is yet to be seen if it can live up to that billing dethrone the current smart king.

Ethereum has a first-mover advantage in the sector working in its favour despite its issues. Other blockchains also reference it in their design, with many providing compatibility to it. Aside from that, Ethereum developers are actively rolling out updates that are expected to tackle the challenges on the network. Hence, dethroning it might be an arduous task for other ecosystems.

Do you think an alternative layer 1 can surpass Ethereum’s dominance in the crypto industry? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.