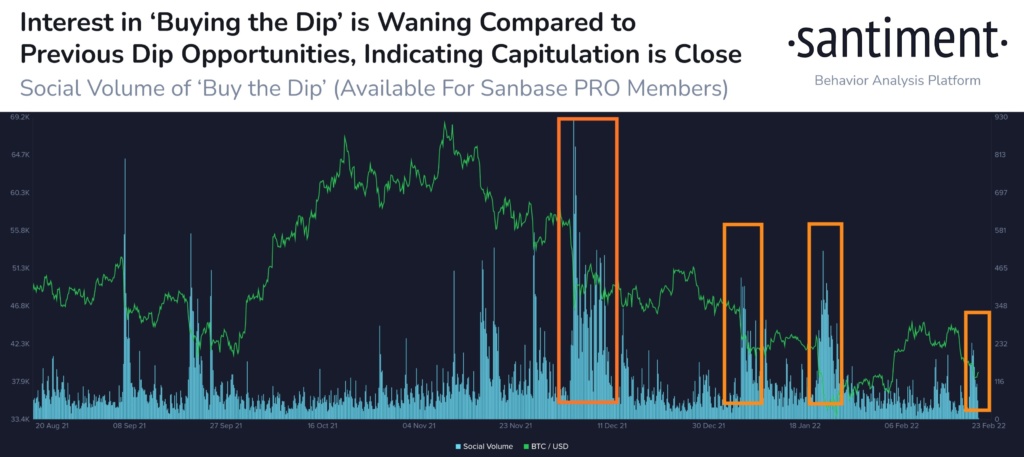

Low volumes of ‘Buy the Dip’ mentions across social media indicates retail investor may have lost interest in the crypto market amidst uncertain macro headwinds.

A behavioural analysis of crypto investors across social media by Santiment reveals a collapse in the volume of words like “#buythedip” across social media. Data collected from social channels like crypto Twitter, crypto SubReddit, crypto Discord groups, Telegram channels, and Pro-Traders chat show a general disinterest in the market. The current sentiment may just be the perfect indicator for market participants to take long positions as historical data shows recovery may be imminent.

Source: Santiment

Macro Headwinds causing loss of Interest

The general loss of interest among traders may result from fears over continued market capitulation in the face of macro headwinds. The Feds intended March interest rate hike, coupled with the Russia-Ukraine crisis and civil unrest in Canada, have caused heavy sell pressure for Bitcoin.

The prevailing macro winds have caused the Bitcoin market to struggle with prices trading below the psychological $40000 support level. The situation has increased the probability of a sustained, with on-chain data showing that investors are currently carrying out de-risking measures.

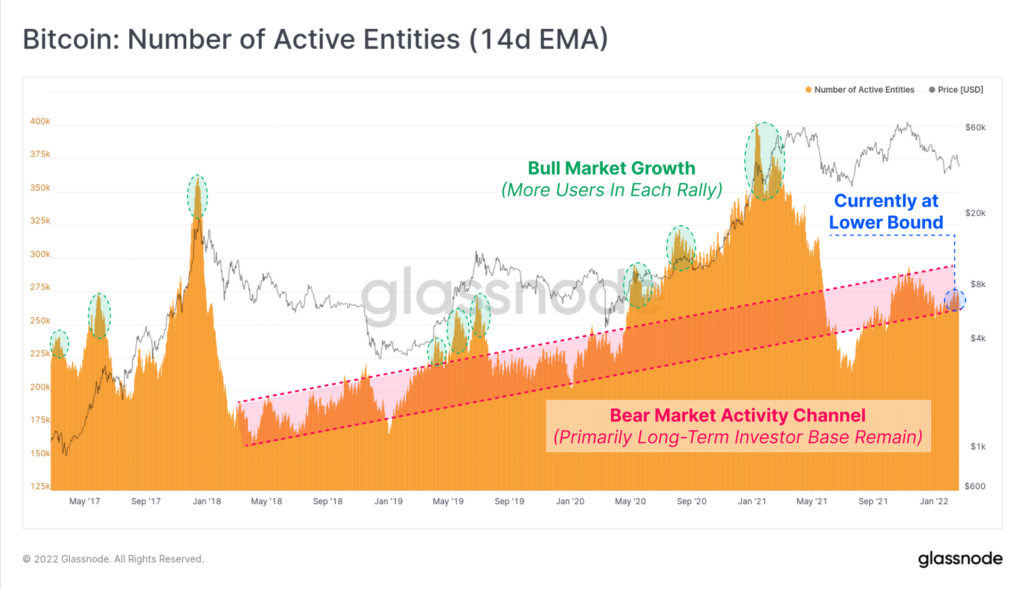

The aforementioned social media data and several on-chain metrics support this current market narrative. According to Glassnode, bear markets are defined by periods of low network activity and lower retail interest, as depicted in the red channel below.

Source: Glassnode

The lower bound of this channel has traditionally increased at a near-linear pace, implying that Bitcoin users (HODLers) are still rising. The level of on-chain activity, on the other hand, is stuck below the lower level of the bear market channel. This usually is a sign of falling interest and demand for the asset.

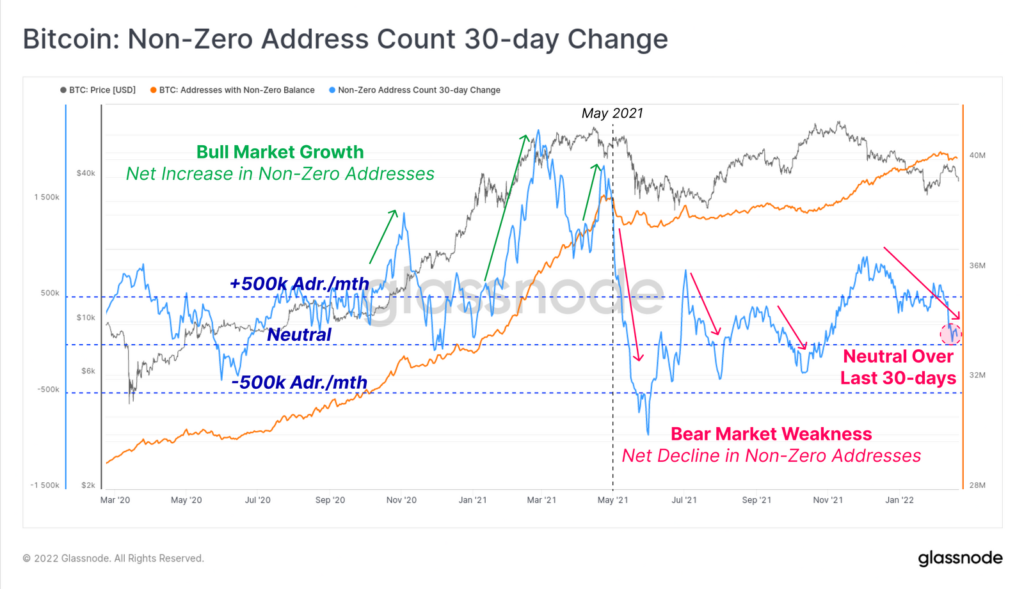

Furthermore, a look at the 30-day change in non-zero balance addresses gives credence to the bear narrative. While the general non-zero balance address creation trend is upward, it has weakened over the recent 30-days. This is due to certain investors entirely emptying their address balances.

Source: Glassnode

The data reveals that around 219k addresses (0.54% of addresses) have been emptied in the last month. This is important to note as it may indicate further sell-off, similar to what happened in March 2021.

Russia-Ukraine Conflict Aggravates Current Market Sentiments

Fear has grown in the stock and crypto markets as the Russia-Ukraine war has escalated. According to Arcane Research, Bitcoin’s 90-day correlation to the S&P 500 reached its highest level since October 2020.

The stock market across Europe has felt the effect of the conflict. The Stoxx Europe 600 index lost 1.9% on Monday before recovering and closing at a 1.3% fall. Additionally, the FTSE All-World share index was down 2.2% this month after losing six of its last eight sessions.

Gold spot prices, which had risen by 5% at the end of January, fell by 0.1% to $1,896. Finally, Brent crude rose 1.9% to $95.27 per barrel in a counter-trend move since oil prices just hit seven-year highs due to the spat.

Investors have been more cautious in their reactions to the constant flow of information about Russia’s intentions in Ukraine. Bad news would cause the market to fall more, whilst reducing tensions would encourage investors to become more bullish.

Do you think the market bottom is close? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.