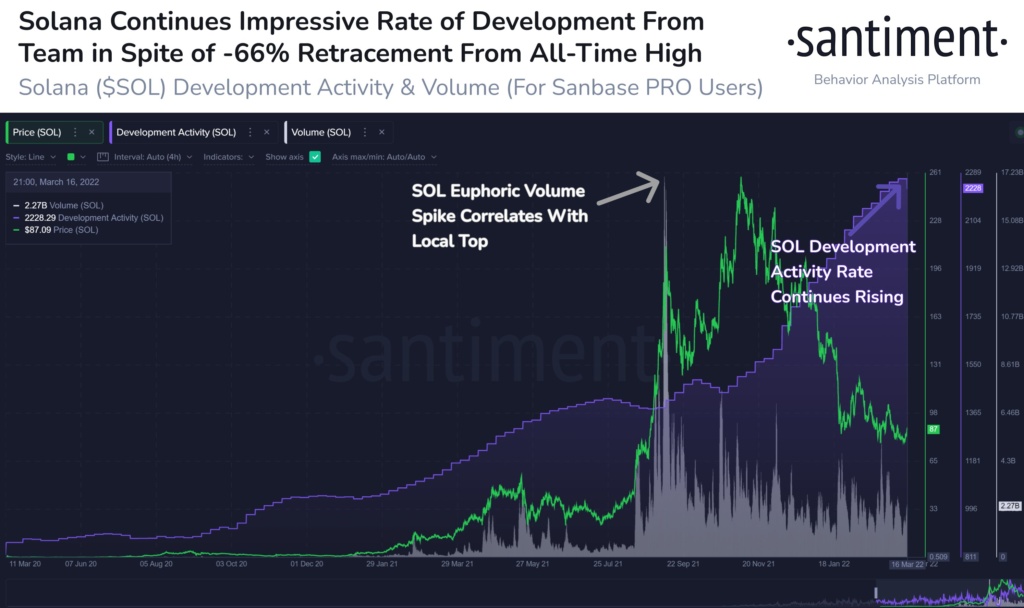

Data reveals an inverse correlation between Solana’s price and the developer activity on the network.

Santiment has revealed data that shows developer activities on the Solana ecosystem continuing apace despite its recent price slump. Since recording its all-time high value of $260 in November 2021, Sol has fallen nearly 66% in line with general market conditions. However, there has been a sharp rise in developer activities as they continue to improve the network’s capabilities.

Source: Santiment

The chart above shows an inverse relationship between both metrics forming after Sol’s November surge in price. Before that, they had primarily maintained a linear correlation, with developer activities growing in line with the price.

This invariable implies that the developers within the ecosystem are not bothered about the fall in the price. Instead, they are more concerned about working on the technical issues prevalent within the network while working on its roadmap.

More Correlation Between Volume and Price Action

Another notable observation from the chart is the direct relationship between volume and price action. From January 2021, all spikes in volume have coincided with an upward surge in the price of Solana.

The data shows that notable spikes in volume in February, March, April and May 2021 caused the first significant surge in Sol’s value. Afterwards, the volume receded, and the price slumped and ranged until August 2021. Since then, both metrics have remained in step with each other except in November, when Solana’s price increase did produce an equivalent volume rise.

Incidentally, the solana ecosystem continues to be a significant challenger of the Ethereum network due to its speed and scalability. Data released by Coin98 Analytics shows that Solana offers the lowest average block time of all alternative blockchains. Its block time of 0.6 seconds makes it one of the fastest chains available.

Also, Solana trumps all other chains, including Ethereum, in the active developer count metric. Despite the price slump, the increased number of devs can easily be linked to the spike in developer activities.

Despite Active Development, Solana Struggles To Maintain TVL

Despite increased developer activity and a growing number of devs, the total value locked in the chain has plummeted drastically. The fall has primarily mirrored the general slump in the overall crypto market, with investors reducing their positions in speculative calls.

Source: Defillama

According to Defillama, the TVL in the solana ecosystem currently stands at $6.96 billion. This represents an over 50% fall from the value recorded in November 2021, which was $15 billion.

Amongst the protocols native to the solana chain, Serum has the highest TVL, with $916.92 million. Solend and Marinade Finance round up the top three with $643.86 and $640.68 million, respectively.

In conclusion, compared to other chains, Solana ranks fifth in TVL ahead of Fantom but behind Ethereum, Terra, BSC and Avalanche. This shows that, despite beating Ethereum in several metrics, it still has a long way to go to become the top DeFi ecosystem. That may be why more developers have been hired and activities increased.

Do you think Solana stands a chance to challenge Ethereum as the premier smart contract platform? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.