Nigeria’s eNaira ranks highest among retail CBDCs globally; however, Nigerians continue to prefer Bitcoin and other cryptocurrencies.

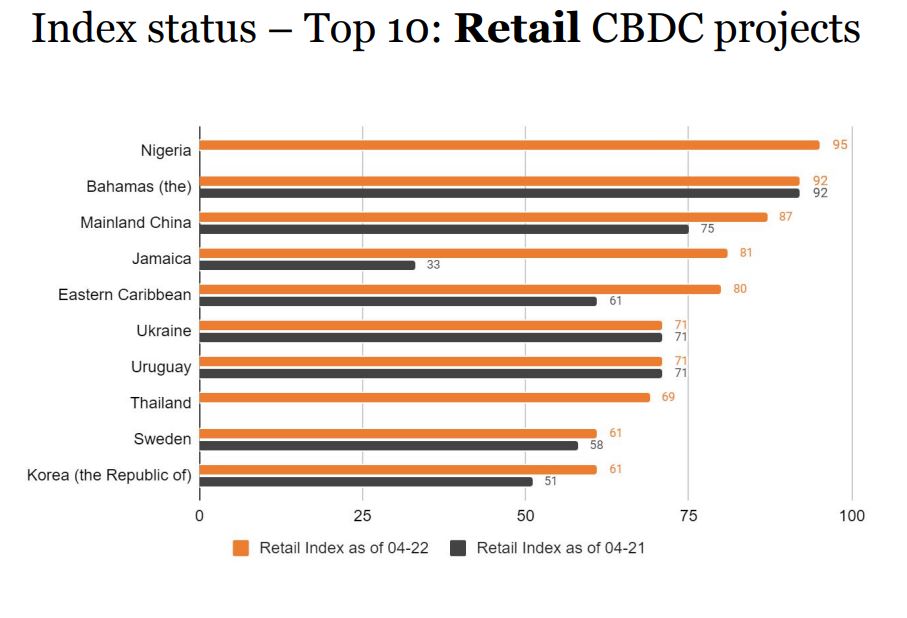

The 2022 PwC CBDC Global Index was released yesterday, 4 April, with Nigeria’s eNaira ranked as the leading retail Central Bank Digital Currency (CBDC) project. The Index evaluates the current stage of CBDC project development globally, taking into account central bank opinions and public interest.

Source: 2022 PwC CBDC Global Index

The report further highlighted the growing importance and adoption of CBDCs in the global financial market. It estimates that more than 80% of central banks are considering launching a CBDC or have already done so.

Furthermore, it revealed that retail CBDC projects—digital currencies designed for public use— have reached greater maturity levels than wholesale projects—digital currencies used by financial institutions. The eNaira, the Bahamas’ Sand dollar, China’s digital Yuan and Jamaica’s JAM-DEX fall into the retail CBDC category. However, the latter category has made significant strides in the past year.

Local Interest In eNaira Dwindles

Despite securing a top spot in the global CBDC ranking, Nigerians have expressed dissatisfaction with the eNaira. Many users complained about the supporting wallets functionality and the difficulty in registering themselves onto the platform.

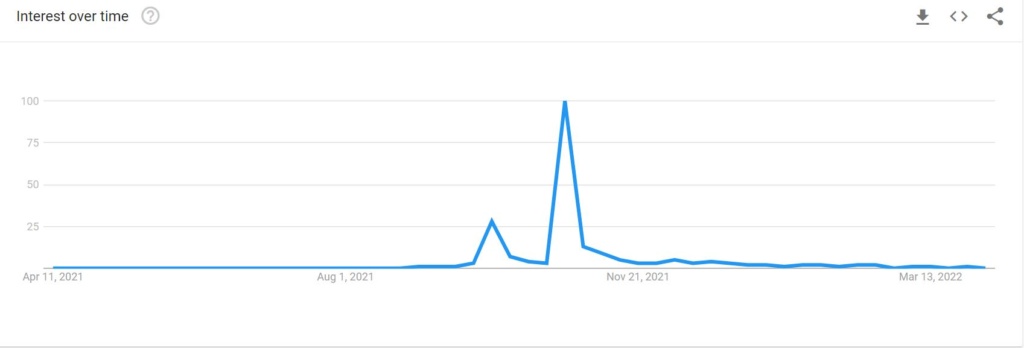

The dissatisfaction has now led to significant disinterest in the digital iteration of the Naira. According to Google trends data, interest in the eNAira has dipped to lows last seen before the announcement of the digital asset. It further revealed that the bulk of current interest is domiciled in the North, with Yobe, Kano and Adamawa leading interest levels.

Source: Google Trends

The chart above shows that between late October and early November 2021, interest in the eNaira skyrocketed. The period coincided with the launch of the eNaira as a legal tender indicating an outstanding level of enthusiasm among Nigerians. Within the same timeframe, interest in Bitcoin and other cryptocurrencies waned.

However, the interest level in Bitcoin and other digital assets has continued to increase. Several crypto adoption initiatives have been launched across Nigeria to raise public awareness about the advantages of the space. Binance and FTX continue to lead the growing adoption causing spikes in interest among Nigerians.

Nigeria’s Interest In Bitcoin Ranks High Globally

The surge of interest in Bitcoin and digital assets has led to Nigeria ranking fifth for global scrutiny in crypto. The growing attention has also led to Nigerians looking for job opportunities within the industry to earn a living. Consequently, Nigerians command a decent slice of salary withdrawals in the space.

For more attention to return to the eNaira, the Central Bank of Nigeria (CBN) would need to take drastic measures. One of such measures would include updating the eNaira wallet apps to improve their functionality and reliability.

Secondly, it may need to review its existing policy, which restricts money deposit banks from enabling crypto transactions. It can go further to enact new regulations that ensure that all crypto deposits and withdrawals are made using the eNaira. This would significantly increase the demand and use of the eNaira.

These measures would be necessary because the eNaira’s rank shows that the CBN has struck gold. It is only imperative that Nigerians get to use the financial tool, which promises more financial inclusivity while helping reduce the amount of Naira in circulation.

Do you think interest in the eNaira can be revived by a change of tact from the CBN? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.