The CBN fines several money deposit banks for failing to restrict customer accounts carrying out crypto transactions despite restrictions.

Reports suggest that the Central Bank of Nigeria (CBN) has fined four commercial banks over ₦800 million for failing to comply with its crypto directives. The banks in question were disciplined over their failure to comply with regulations prohibiting customers from transacting in cryptocurrencies.

According to the reports, the sanctions by the CBN are part of its efforts to clamp down on cryptocurrencies. The move would prevent the trading of digital assets through commercial banks. The affected bank include Stanbic IBTC bank (₦200 million), Access bank (₦500 million), United Bank of Africa (₦100 million) and Fidelity Bank (₦14.3 million).

CBN Restriction only Targeted Banks Enabling Crypto Transactions

The CBN, in February 2021, issued a circular instructing all commercial banks to desist from transacting in/and with entities dealing in cryptocurrencies. This led to a widespread uproar among crypto enthusiasts in Nigeria, who saw the move as an outright ban on digital currency.

Later on, the CBN issued another statement to clarify its position, saying it did not place any new restrictions on cryptocurrencies. The apex reiterated that it had already forbidden Nigerian financial institutions from dealing with crypto right from 2017. It had also issued a reminder in 2018 before doing so again in February.

Following its strict stance, the commercial banks stopped direct transactions in crypto. This led to crypto traders in Nigeria looking for alternative measures to trade cryptocurrencies. In no time, peer-to-peer markets emerged, with traders carrying out transactions directly among themselves.

With the volume of crypto transactions rising, the CBN continued to crack down on individuals transacting through banks. In November, commercial banks were ordered to freeze the accounts of individuals engaged in crypto trading. This directive was issued through a post-no-debit circular authorised by the Director of Banking Supervision, J. Y. Mammanand.

The new directive caused Nigerian users to take to Twitter to warn about the closure of accounts and express their shock. They also warned traders that government agents had been planted on P2P platforms to notify banks of those transacting crypto.

Since then, banks have increased their scrutiny. However, with the current sanctions meted by the CBN, a few transactions may have slipped through their watch. The apex bank says it can detect transactions that commercial banks may have missed. The affected banks have now called on the regulatory body to share its advanced capability technology.

P2P Markets Flourishes In Nigeria As Crypto Interest Continues To Grow

Despite the embargoes in place, interest in cryptocurrency amongst Nigerians has not waivered one bit. Instead, it has continued to grow exponentially, with Nigeria recently ranking 5th for crypto interest globally.

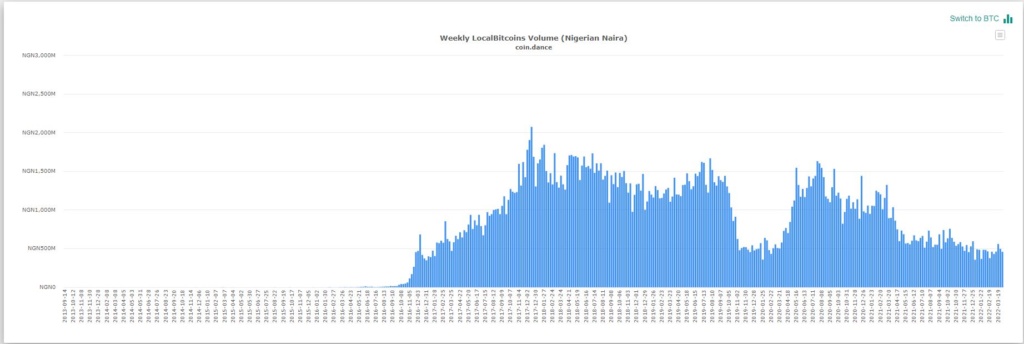

The growing interest has led to a boom in crypto transactions in Nigeria as the P2P marketplace flourishes. Data from Local Bitcoin shows that crypto transaction volumes in Nigeria continue to average above ₦450 million.

Source: Local Bitcoin

The chart above shows that transaction volume surpassed ₦500 million in March as citizens continue to choose crypto in the face of economic challenges.

With the CBN unwavering in its stance against cryptocurrencies trading through commercial banks, traders should be careful to ensure they do not have their accounts closed. However, the CBN may need to change its policy to enhance further Nigeria’s burgeoning reputation as a digital asset first country.

Do you think the sanctioned banks deserve their punishment despite complying with the CBN’s directives? Let us know your thoughts in the comments below.

Chris is a crypto enthusiast and a firm believer in the blockchain’s ability to create a new financial paradigm. Through writing, Chris hopes to expose the intricacies of this disruptive technology and how it is beneficial to Africans and developing countries. He aims to give readers a rational and unbiased outlook of the industry by equipping them with the necessary information to make enlightened investment decisions.