US citizens have amassed the most crypto gains in the last bull cycle despite many regulatory constraints.

The year 2021 closed on a good note for many crypto investors who smiled to the bank. However, a closer inspection has shown that some countries enjoyed more gains than others. While emerging markets lead the crypto adoption race, they seem to be falling behind in trade volumes and profit.

It is surprising to see that the frustrating regulatory framework in the US has not deterred citizens from participating in the crypto market. These constraints have left Americans with very few options to enjoy crypto gains for years. However, it would seem that they are making the most of the little access they have.

Realized Profits in 2021 Smashes Previous Year

Blockchain intelligence company, Chainalysis, has revealed some intriguing developments in the crypto space from their latest report. In 2020, the total realized cryptocurrency gains were estimated at $32.5 billion. This value pales compared to the $162.7 billion profit recorded in 2021.

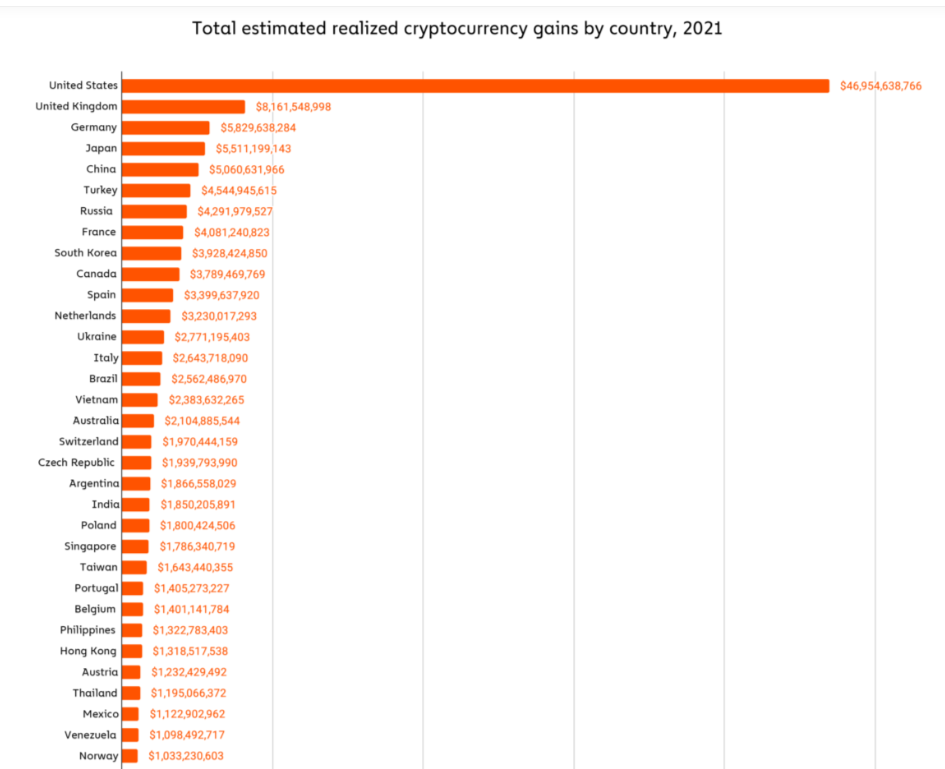

Source: Chainalysis

The graph above shows that the United States accounts for almost $47 billion in realized cryptocurrency gains. This sum has earned the country’s top spot on the list of nations with the highest profit by a wide margin. The UK (~$ 8.2 billion), Germany (~$ 6 billion), and Japan ($5.5 billion) occupied second, third and fourth spots, respectively. Meanwhile, China stands in fifth place with a little above $5 billion in profit. The report highlighted a decline in the activities of Chinese citizens compared to its peers despite the significant improvement from the previous year. The East Asian country recorded only $1.7 billion in 2020, which was one-third of the gains seen the following year.

However, compared to other countries, China suffered a slower growth rate. Its year-over-year profit increase rate stood at 194%. On the other hand, the United States recorded about 476% ascent in 2021. Other countries witnessed growth at a similar pace. For instance, the UK and Germany saw a 431% and 423% rise. A likely cause of this slower pace may have been the government clampdown on crypto-related activities within the country.

Emerging markets lag in realized crypto profit

The report exposed the nature of participation from various regions. Although the US recorded the most gains, a few emerging markets also left their footprint. South Africa was the only African country to appear among the 50 nations. With a total profit of about 828 million, the African country emerged as the 39th on the list.

While African countries have led the crypto adoption race, it may seem that they have a long way to go in individual trade volume. Although the average number of African participants in crypto has been on the rise, the financial strength is still lacking as gains are always proportional to the sum invested. It is safe to say that we can expect more inflow with increased financial capacity in the future, given the current interest. With depreciating currencies and possible interest rate hikes, emerging economies stand a chance to gain the most from the crypto market.

This development indicates that the crypto market has a lot of room. If the level of adoption in emerging economies matches other parts of the world, the digital currency might be on its way to flipping many more financial assets.

Do you think emerging markets will close this gap before the next bull run? Let us know your thoughts in the comments below.

Kingsley is a fintech writer with over 4 years of experience covering blockchain and cryptocurrency news. Alo first discovered Bitcoin in 2016 and has been passionate about it ever since, particularly the various ways blockchain can help Africa and the world at large. He desires to give the crypto space a more geographically balanced narrative and serve as a bridge between Africa and the rest of the world. His articles have been featured in Cointelegraph, Beincrypto, and Forkast.news, among others.